***

Praise

“A witty, concise and delightfully logical guide for the high-tech entrepreneur. Everything you need to know, but not a line more. I’m already recommending it to the faculty, students and business colleagues who are starting companies.”

Lita Nelsen

Director, Technology Licensing Office

Massachusetts Institute of Technology

Cambridge, Massachusetts

“I wish this book were around when I started my first company. The entrepreneur can learn in one evening’s reading what it took me two years of learning-by-doing! I plan on giving a copy to every CEO in our venture fund’s portfolio.”

Gordon B. Baty

Partner, Zero Stage Capital

Cambridge, Massachusetts

The Best Book on Financial Statements, Period! Wow, what a great book! I’m a technical professional and now no longer in the financially confused majority.

—Robert I. Hedges (Burnsville, MN)

Simply the Best! Clearly the first introductory book one should read. This book—a must on every managers shelf—adds value by providing clear and concise definitions and relates them visually to the changing financial statements. A tremendous bang for buck. Simply go get it and read it.

—ClimbHigh

The author has a gift that few experts have. He anticipates all my newbie/beginner stupid questions… As soon as the little voice in my head asks, “But why did they do it this way?” the author gives me the answer. This book has been of enormous value to me. It is an essential reference for anyone who needs to understand what business finances are about.

—M. Kramer (United States)

A Masterpiece. Every single financial term is clarified with a layman’s language. Moreover, for every single term, there is a very understandable example. Likewise, in every page there is a sheet explaining all the transactions. I strongly believe that this book is a masterpiece for non-financial managers.

—a reader

Excellent! I purchased this book for an MBA course and ended up using it more than the assigned text. The author makes a complicated subject seem like child’s play!

—Bill Holcomb (Cleveland, OH)

Perfect book when first learning… This is a wonderfully clear and concise introduction to the interpretation of financial statements… Read this if you are not a CPA or MBA, but must “get a handle” on Balance Sheets, Income Statements and Cash Flow Statements. This should be the first book you buy.

—Jack Fossen (Dallas, TX)

Outstanding!! Looking to understand how financial statements work?…then purchase this book—there’s none better. I am a graduate student nearing the completion of my MBA degree. The author speaks in basic terms about what financial statements mean and how they work. This book puts it all together for the reader.

—Joseph P. Gallagher (Bellinghan, WA)

A very useful book. While the book gets only skin deep on accounting concepts, it does an excellent job in deconstructing how the Income Statement, Statement of Cash Flows, and Balance Sheet are changed. Very few accounting related books make explicit what happens the way this book does.

—R. Chonchol (Florida)

Want to understand financial statements? I took an accounting class…and I had difficulty interpreting financial statements. So I gambled and bought this book with a hope to unravel the mystery on financial statements. It really worked! Overall, the knowledge gained exceeds multiple folds of the time and money invested on this book!

—Tuan minh Tran

Excellent, buy it!! If you are in the finance business, of any kind, and you are not an accountant, this book is for you.

—Richard Gomez (San Diego, CA)

WOW, Incredible. I took an accounting course at University, I now wish that my professor used this book in the course. So easy to understand and with great examples. Suitable for anyone who wants to learn accounting the fast and easy way.

—Kavkazy (Toronto, Canada)

Acknowledgments

Many people helped make this book possible. My special thanks go to Isay Stemp, who first showed me that knowing a little finance and accounting could be fun; to my agent, Michael Snell, who taught me how to write a book proposal; and to Lisa Berkman, whose encouragement was invaluable as I drafted this revised and expanded edition.

Many thanks to my publisher, Ronald Fry of Career Press, for seeing promise in a preliminary version of this book and to Kristen Parkes, editorial director for Career Press, for her guiding of this book through to publication.

Again with this second edition, as was the case with the first, I am indebted to my colleague Jack Turner for his thoughtful review of the words and numbers in this book. Also a special thanks to Graham Eacott for his careful reading and correction of the first edition.

These clients, colleagues and friends at one time or another helped me to develop (whether they realized it or not) the concepts presented in this book. My thanks to Gwen Acton, Marci Anderson, Molly Downer, Tim Duncan, Cavas Gobhai, Jack Haley, Katherine Leahey, Paul McDonough, Lita Nelsen, Paul O’Brien, Mel Platte, and Iruna and Chris Simmons.

Preface

If the first edition of this book was an entrepreneurial business, it would be a huge success. Now over 100,000 copies of Financial Statements: A Step-by-Step Guide to Understanding and Creating Financial Reports are in-press and helping non-financial managers and students of accounting and finance cope with the “numbers of business.”

With this new revised second edition, we have expanded the book into five sections from the original three. Many readers of the first edition wanted to better understand capital investment decision-making, which is the focus of our two new sections.

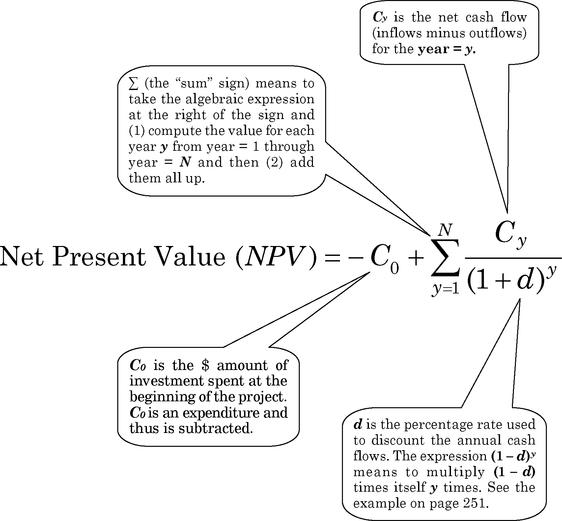

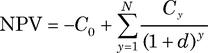

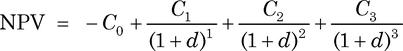

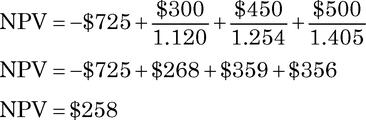

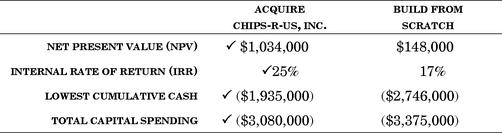

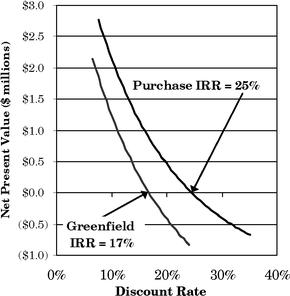

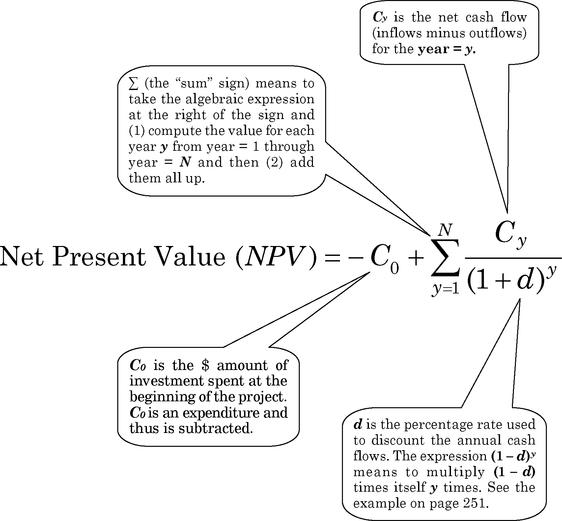

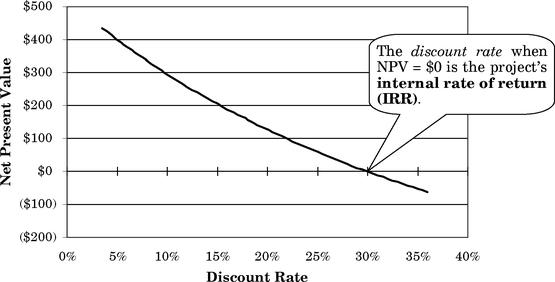

Capital is often a company’s scarcest resource, and using capital wisely is essential for success. The chief determinant of what a company will become is the capital investments it makes today. So in this new edition, we will use the financial analysis techniques of net present value (NPV) and internal rate of return (IRR) as capital investment decision-making tools

Introduction

Many non-financial managers have an accounting phobia …a financial vertigo that limits their effectiveness. If you think “inventory turn” means rotating stock on the shelf, and that “accrual” has something to do with the Wicked Witch of the West, then this book’s for you.

Financial Statements: A Step-by-Step Guide to Understanding and Creating Financial Reports is designed for those business professionals (1) who know very little about accounting and financial statements, but feel they should, and those (2) who need to know a little more, but for whom the normal accounting and financial reporting texts are mysterious and un-enlightening. In fact, the above two categories make up the majority of all people in business. You are not alone.

Financial Statements: A Step-by-Step Guide to Understanding and Creating Financial Reports is a transaction-based, business training tool with clarifying, straightforward, real-life examples of how financial statements are built and how they interact to present a true financial picture of the enterprise.

We will not get bogged down in details that get in the way of conceptual understanding. Just as it is not necessary to know how the microchips in your computer work to multiply a few numbers, it’s not necessary to be a Certified Public Accountant (CPA) to have a working knowledge of the “accounting model of the enterprise.”

Transactions. This book describes a sequence of “transactions” of our sample company, AppleSeed Enterprises, Inc., as it goes about making and selling delicious applesauce. We will sell stock to raise money, buy machinery to make our product, and then satisfy our customers by shipping wholesome applesauce. We’ll get paid and we will hope to make a profit. Then we will expand the business.

Each step along the way will generate account “postings” on AppleSeed’s books. We’ll discuss each transaction to get a hands-on feel for how a company’s financial statements are constructed. We’ll learn how to report using the three main financial statements of a business—the Balance Sheet, Income Statement and Cash Flow Statement—for these common business dealings:

- selling stock

- borrowing money

- receiving orders

- shipping goods

- invoicing customers

- receiving payments

- paying sales commissions

- writing off bad debts

- prepaying expenses

- ordering equipment

- paying deposits

- receiving raw materials

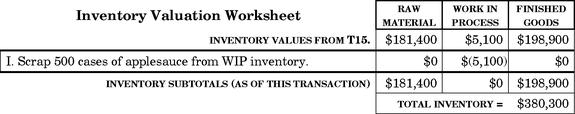

- scrapping damaged product

- paying suppliers

- booking manufacturing variances

- depreciating fixed assets

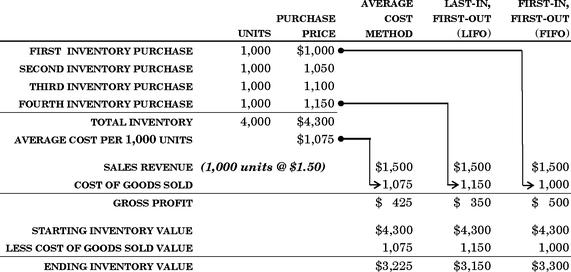

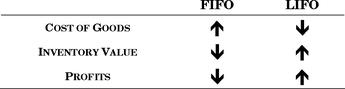

- valuing inventory

- hiring staff and paying salary, wages and payroll taxes

- computing profit

- paying income taxes

- issuing dividends

- acquiring a business

- and more

“Accounting is a language, a means of communicating among all the segments of the business community. It assumes a reference base called the accounting model of the enterprise. While other models of the enterprise are possible, this accounting model is the accepted form, and is likely to be for some time.

“If you don’t speak the language of accounting or feel intuitively comfortable with the accounting model, you will be at a severe disadvantage in the business world. Accounting is a fundamental tool of the trade.”

Gordon B. Baty

Entrepreneurship

Prentice Hall, Englewood Cliffs, NJ, 1990

By the end of this book, you’ll know your way around the finances of our apple-sauce-making company, AppleSeed Enterprises, Inc.

Goals. My goal in writing this book is to help people in business master the basics of accounting and financial reporting. This book is especially directed at those managers, scientists and salespeople who should know how a Balance Sheet, Income Statement and Cash Flow Statement work…but don’t.

Your goal is to gain knowledge of accounting and finance to assist you in your business dealings. You want the power that comes from understanding financial manipulations. You must know how the score is kept in business. You recognize, as Gordon Baty says, you must “feel intuitively comfortable with the accounting model” to succeed in business.

This book is divided into five main sections, each with a specific teaching objective:

Section A. Financial Statements: Structure & Vocabulary will introduce the three main financial statements of the enterprise and define the special vocabulary that is necessary to understand the books and to converse with accountants.

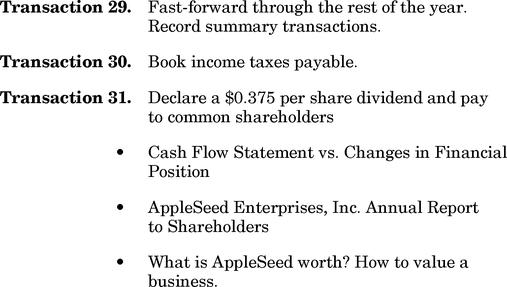

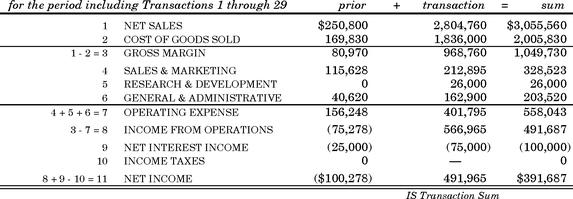

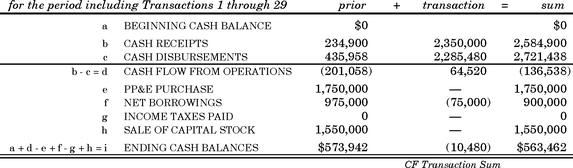

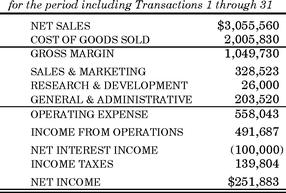

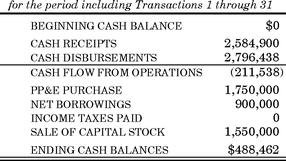

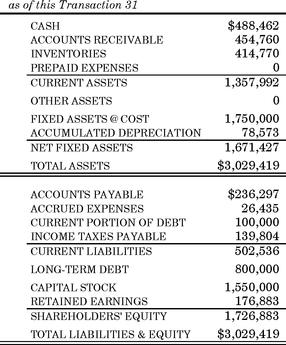

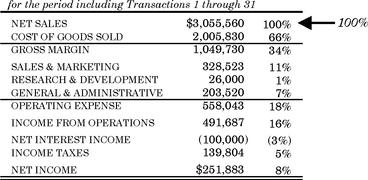

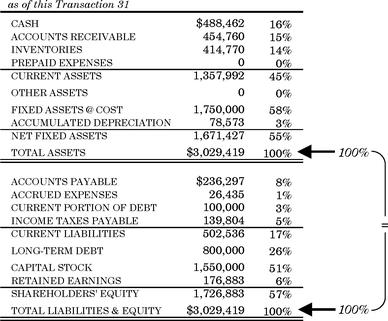

Section B. Transactions: Exploits of AppleSeed Enterprises, Inc. will take us through 31 business transactions, showing how to report financial impact of each on the Balance Sheet, Income Statement and Cash Flow Statement of AppleSeed Enterprises.

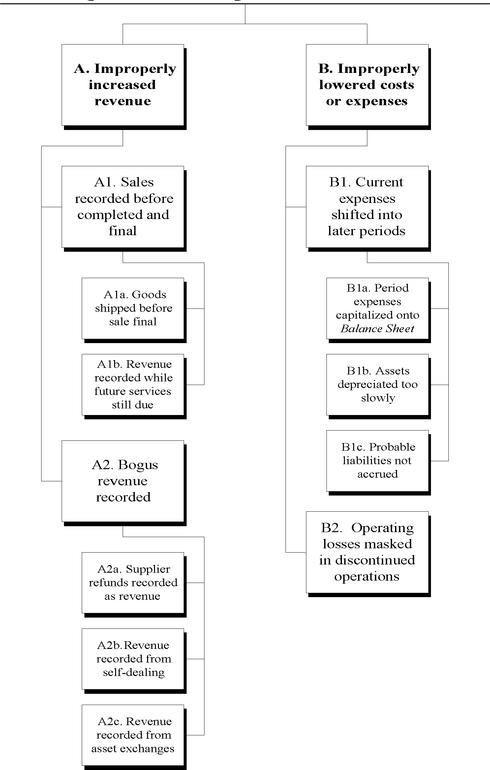

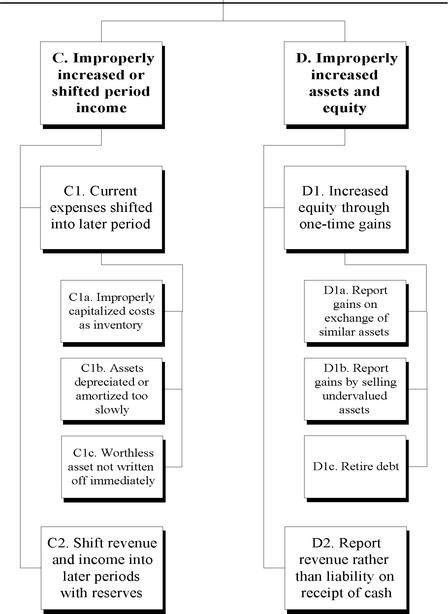

Section C. Financial Statements: Construction & Analysis will subject the financial statement of our sample company to a rigorous analysis using common ratio analysis techniques. Then finally we will touch on how to “cook the books,” why someone would want to, and how to detect financial fraud.

“…even if it’s boring and dull and soon to be forgotten, continue to learn double-entry bookkeeping. People think I’m joking, but I’m not. You should love the mathematics of business.”

Kenneth H. Olsen

entrepreneurial founder of Digital Equipment Corporation

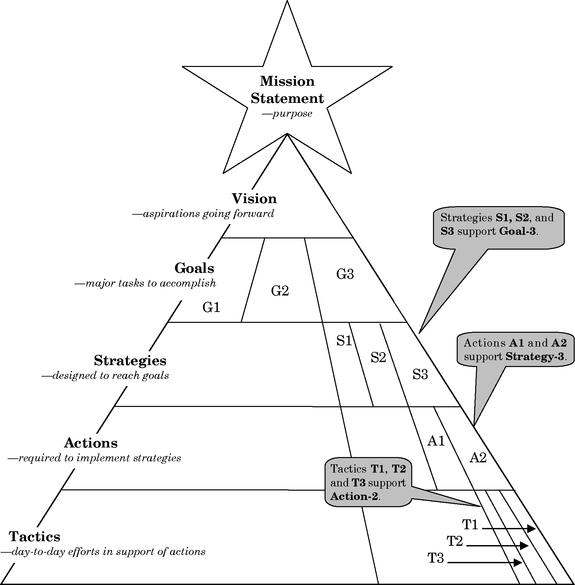

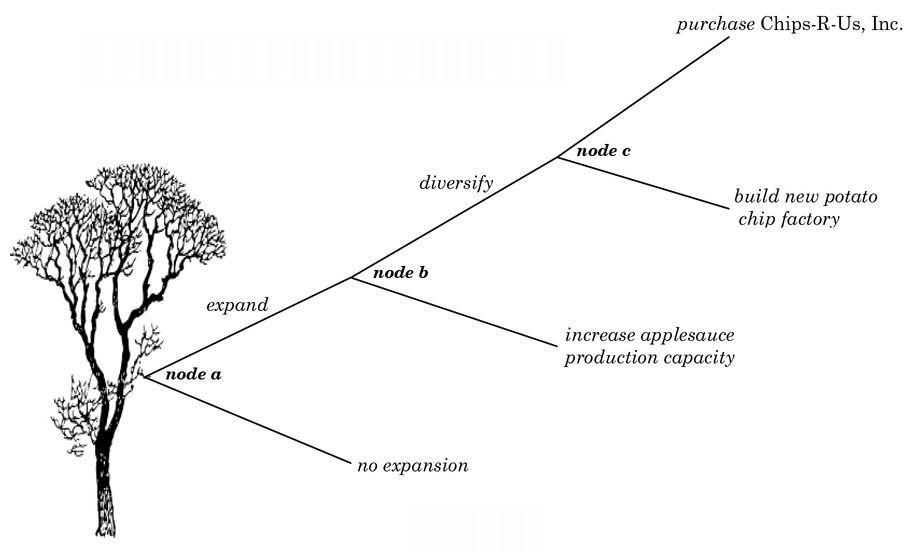

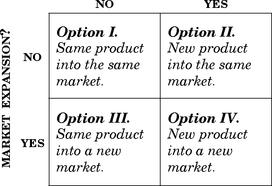

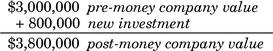

Section D. Business Expansion: Strategy, Risk & Capital will describe the strategic decisions that a fledgling company must make when it expands. We will answer the questions, “Where will we get the money?” and “How much will it cost?”

Then in Section E. Making Good Capital Investment Decisions we will analyze business expansion alternatives and select the best using sophisticated net present value (NPV) techniques.

With your newly acquired understanding of the structure and flow of money in business, you will appreciate these important business quandaries:

- How an enterprise can be rapidly growing, highly profitable and out of money all at the same time…and why this state of affairs is fairly common.

- Why working capital is so very important and which management actions lead to more, which lead to less.

- The difference between cash in the bank and profit on the bottom line, and how the two are interrelated.

- When in the course of business affairs a negative cash flow is a sign of good things happening… and when it’s a sign of impending catastrophe.

- Limits of common product costing systems and when to apply (and, more importantly, when to ignore) the accountant’s definition of cost.

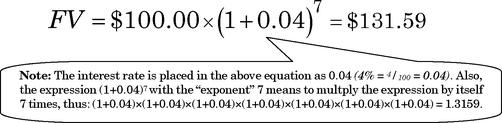

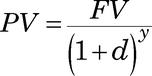

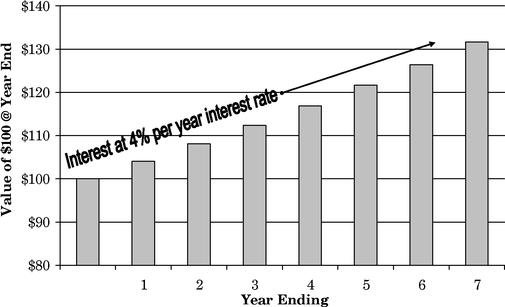

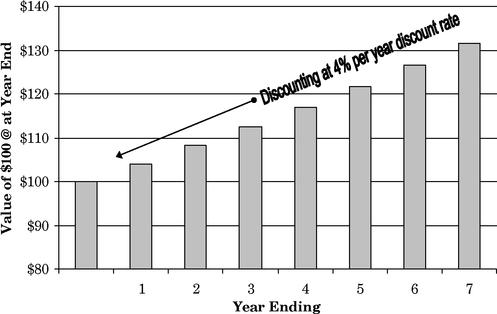

- Why a development investment made today must return a much greater sum to the coffers of the company in later years.

- How discounts drop right to the bottom line as lost profits and why they are so very dangerous to a company’s financial health.

- How risk is different than uncertainty, and which is worse.

- Why a dollar in your pocket today can be worth a lot more than a dollar received tomorrow.

- The necessity (and limitation) of forecasting cash flows over time when making capital investment decisions.

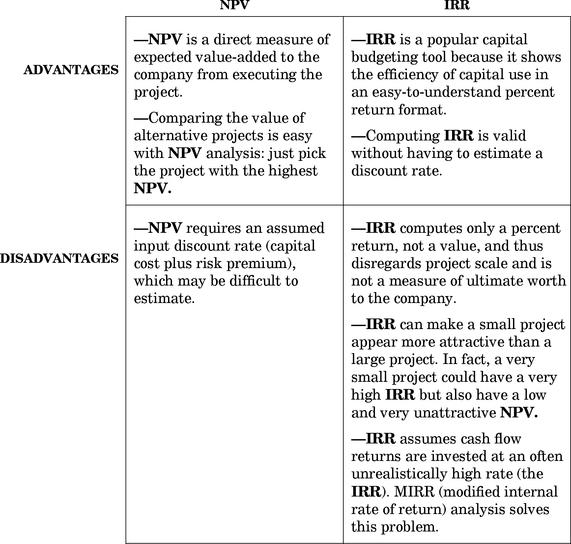

- When to use NPV analysis and when to use IRR, and why it is important in capital investment decision-making.

To be effective in business, you must understand accounting and financial reporting. Don’t become an accountant, but do “speak the language” and become intuitively comfortable with the accounting model of the enterprise.

Read on.

**Section A. Financial Statements: Structure & Vocabulary

About This Section

This book is written for people who need to use financial statements in their work but have no formal training in accounting and financial reporting. Don’t feel bad if you fall into this category. My guess is that 95 percent of all non-financial managers are financially illiterate when it comes to understanding the company’s books. Let’s proceed toward some enlightenment.

This section is about financial statement structure and about the specialized vocabulary of financial reporting. We will learn both together. It’s easier that way. Much of what passes as complexity in accounting and financial reporting is just specialized (and sometimes counterintuitive) vocabulary and basically simple reporting structure that gets confusing only in the details.

Vocabulary. In accounting, some important words may have meanings that are different from what you would think. The box below shows some of this confusing vocabulary. It is absolutely essential to use these words correctly when discussing financial statements. You’ll just have to learn them. It’s really not that much, but it is important. Look at these examples:

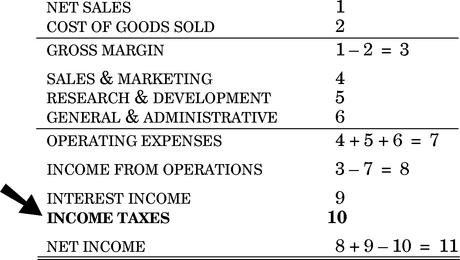

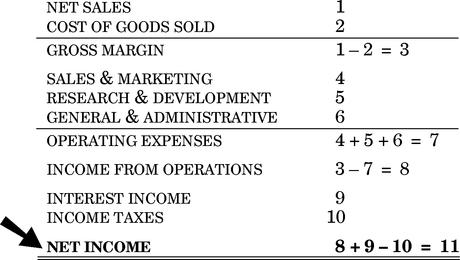

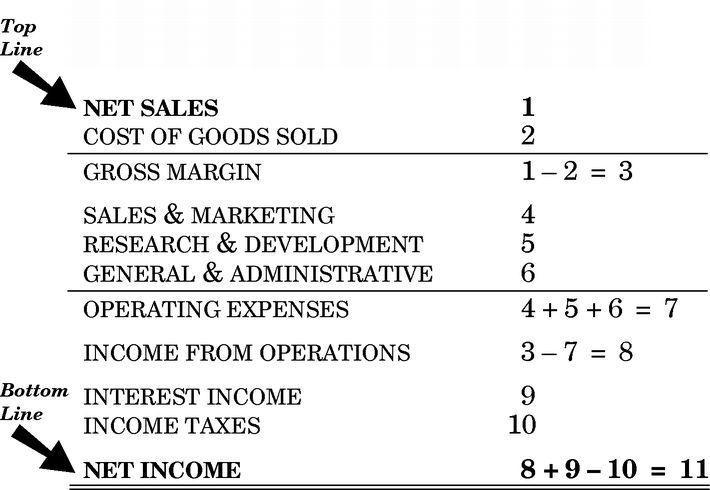

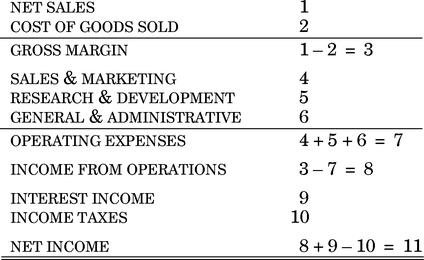

1. Sales and revenue are synonymous and mean the “top line” of the Income Statement, the money that comes in from customers.

2. Profits, earnings and income are all synonymous and mean the “bottom line,” or what is left over from revenue after all the costs and expenses spent in generating that revenue are subtracted.

Note that revenue and income have different meanings. Revenue is the “top line” and income is the “bottom line” of the Income Statement. Got that?

3. Costs are money (mostly for materials and labor) spent making a product. Expenses are money spent to develop it, sell it, account for it and manage this whole making and selling process.

Sales and revenue mean the same thing.

Profit, earnings and income mean the same thing.

Now, revenue and income do not mean the same thing.

Costs are different from expenses.

Expenses are different from expenditures.

Sales are different from orders but are the same

as shipments.

Profits are different from cash.

Solvency is different from profitability.

4. Both costs and expenses become expenditures when money is actually sent to vendors to pay for them.

5. Orders are placed by customers and signify a request for the future delivery of products. Orders do not have an impact on any of the financial statements in any way until the products are actually shipped. At this point these shipments become sales. Shipments and sales are synonymous.

6. Solvency means having enough money in the bank to pay your bills. Profitability means that your sales are greater than your costs and expenses. You can be profitable and insolvent at the same time. You are making money but still do not have enough cash to pay your bills.

Financial Statements. Once you understand the specialized accounting vocabulary, you can appreciate financial statement structure. For example, there will be no confusion when we say that revenue is at the top of an Income Statement and income is at the bottom.

In this section, we will learn vocabulary and financial statement structure simultaneously. Then follows a chapter on each one of the three main financial statements: the Balance Sheet, the Income Statement and the Cash Flow Statement. To end the section, we will discuss how these three statements interact and when changing a number in one necessitates changing a number in another.

Chapter 1 will lay some ground rules for financial reporting—starting points and assumptions that accounting professionals require to let them make sense of a company’s books. In Chapter 2, we will discuss the Balance Sheet—what you own and what you owe. Then in Chapter 3 comes the Income Statement reporting on the enterprise’s product selling activities and whether there is any money left over after all these operations are done and accounted for.

The last statement, but often the most important in the short term, is the Cash Flow Statement discussed in Chapter 4. Look at this statement as a simple check register with deposits being cash in and any payments cash out.

Chapter 5 puts all three financial statements together and shows how they work in concert to give a true picture of the enterprise’s financial health.

Chapter 1. Twelve Basic Principles

Accountants have some basic rules and assumptions upon which rest all their work in preparing financial statements. These accounting rules and assumptions dictate what financial items to measure and when and how to measure them. By the end of this discussion, you will see how necessary these rules and assumptions are to accounting and financial reporting.

So, here are the 12 very important accounting principles:

- 1. accounting entity

- 2. going concern

- 3. measurement

- 4. units of measure

- 5. historical cost

- 6. materiality

- 7. estimates and judgments

- 8. consistency

- 9. conservatism

- 10. periodicity

- 11. substance over form

- 12. accrual basis of presentation

These rules and assumptions define and qualify all that accountants do and all that financial reporting reports. We will deal with each in turn.

1. Accounting Entity. The accounting entity is the business unit (regardless of the legal business form) for which the financial statements are being prepared. The accounting entity principle states that there is a “business entity” separate from its owners…a fictional “person” called a company for which the books are written.

2. Going Concern. Unless there is evidence to the contrary, accountants assume that the life of the business entity is infinitely long. Obviously this assumption can not be verified and is hardly ever true. But this assumption does greatly simplify the presentation of the financial position of the firm and aids in the preparation of financial statements.

If during the review of a corporation’s books, the accountant has reason to believe that the company may go bankrupt, he must issue a “qualified opinion” stating the potential of the company’s demise. More on this concept later.

3. Measurement. Accounting deals with things that can be quantified—resources and obligations upon which there is an agreed-upon value. Accounting only deals with things that can be measured.

This assumption leaves out many very valuable company “assets.” For example, loyal customers, while necessary for company success, still cannot be quantified and assigned a value and thus are not stated in the books.

Financial statements contain only the quantifiable estimates of assets (what the business owns) and liabilities (what the business owes). The difference between the two equals owner’s equity.

4. Units of Measure. U.S. dollars are the units of value reported in the financial statements of U.S. companies. Results of any foreign subsidiaries are translated into dollars for consolidated reporting of results. As exchange rates vary, so do the values of any foreign currency denominated assets and liabilities.

5. Historical Cost. What a company owns and what it owes are recorded at their original (historical) cost with no adjustment for inflation.

A company can own a building valued at $50 million yet carry it on the books at its $5 million original purchase price (less accumulated depreciation), a gross understatement of value.

This assumption can greatly understate the value of some assets purchased in the past and depreciated to a very low amount on the books. Why, you ask, do accountants demand that we obviously understate assets? Basically, it is the easiest thing to do. You do not have to appraise and reap-praise all the time.

6. Materiality. Materiality refers to the relative importance of different financial information. Accountants don’t sweat the small stuff. But all transactions must be reported if they would materially affect the financial condition of the company.

Remember, what is material for a corner drug store is not material for IBM (lost in the rounding errors). Materiality is a straightforward judgment call.

7. Estimates and Judgments. Complexity and uncertainty make any measurement less than exact. Estimates and judgments must often be made for financial reporting. It is okay to guess if: (1) that is the best you can do and (2) the expected error would not matter much anyway. But accountants should use the same guessing method for each period. Be consistent in your guesses and do the best you can.

8. Consistency. Sometimes identical transactions can be accounted for differently. You could do it this way or that way, depending upon some preference. The principle of consistency states that each individual enterprise must choose a single method of reporting and use it consistently over time. You cannot switch back and forth. Measurement techniques must be consistent from any one fiscal period to another.

9. Conservatism. Accountants have a downward measurement bias, preferring understatement to overvaluation. For example, losses are recorded when you feel that they have a great probability of occurring, not later, when they actually do occur. Conversely, the recording of a gain is postponed until it actually occurs, not when it is only anticipated.

10. Periodicity. Accountants assume that the life of a corporation can be divided into periods of time for which profits and losses can be reported, usually a month, quarter or year.

What is so special about a month, quarter or year? They are just convenient periods; short enough so that management can remember what has happened, long enough to have meaning and not just be random fluctuations. These periods are called “fiscal” periods. For example, a “fiscal year” could extend from October 1 in one year till September 30 in the next year. Or a company’s fiscal year could be the same as the calendar year starting on January 1 and ending on December 31.

11. Substance Over Form. Accountants report the economic “substance” of a transaction rather than just its form. For example, an equipment lease that is really a purchase dressed in a costume, is booked as a purchase and not as a lease on financial statements. This substance over form rule states that if it’s a duck…then you must report it as a duck.

“Lines” are perhaps not as important as principles, but they can be confusing if you don’t know how accountants use them in financial statements. Financial statements often have two types of lines to indicate types of numeric computations.

Single lines on a financial statement indicate that a calculation (addition or subtraction) has been made on the numbers just preceding in the column.

The double underline is saved for the last. That is, use of a double underline signifies the very last amount in the statement.

Note that while all the numbers in the statement represent currency, only the top line and the bottom line normally show a dollar sign.

FASB1makes the rules and they are called GAAP.2

1Financial Accounting Standards Board; 2Generally Accepted Accounting Principles

12. Accrual Basis of Presentation. This concept is very important to understand. Accountants translate into dollars of profit or loss all the money-making (or losing) activities that take place during a fiscal period. In accrual accounting, if a business action in a period makes money, then all its product costs and its business expenses should be reported in that period. Otherwise, profits and losses could flop around depending on which period entries were made.

In accrual accounting, this documentation is accomplished by matching for presentation: (1) the revenue received in selling product and (2) the costs to make that specific product sold. Fiscal period expenses such as selling, legal, administrative and so forth are then subtracted.

Key to accrual accounting is determining: (1) when you may report a sale on the financial statements, (2) matching and then reporting the appropriate costs of products sold and (3) using a systematic and rational method allocating all the other costs of being in business for the period. We will deal with each point separately:

Revenue recognition. In accrual accounting, a sale is recorded when all the necessary activities to provide the good or service have been completed regardless of when cash changes hands. A customer just ordering a product has not yet generated any revenue. Revenue is recorded when the product is shipped.

Matching principle. In accrual accounting, the costs associated with making products (Cost of Goods Sold) are recorded at the same time the matching revenue is recorded.

Allocation. Many costs are not specifically associated with a product. These costs must be allocated to fiscal periods in a reasonable fashion. For example, each month can be charged with one-twelfth of the general business insurance policy even though the policy was paid in full at the beginning of the year. Other expenses are recorded when they arise (period expenses).

Note that all businesses with inventory must use the accrual basis of accounting. Other businesses may use a “cash basis” if they desire. Cash basis financial statements are just like the Cash Flow Statement or a simple checkbook. We’ll describe features of accrual accounting in the chapters that follow.

Who makes all these rules? The simple answer is that “FASB” makes the rules and they are called “GAAP.” Note also that FASB is made up of “CPAs.” Got that?

Financial statements in the United States must be prepared according to the accounting profession’s set of rules and guiding principles called the Generally Accepted Accounting Principles, GAAP for short. Other countries use different rules.

GAAP is a series of conventions, rules and procedures for preparing and reporting financial statements. The Financial Accounting Standards Board, FASB for short, lays out the GAAP conventions, rules and procedures.

The FASB’s mission is “to establish and improve standards of financial accounting and reporting for guidance and education of the public, including issuers, auditors, and users of financial information.” The Securities and Exchange Commission (SEC) designates FASB as the organization responsible for setting accounting standards for all U.S. public companies.

CPAs CPAs are, of course, Certified Public Accountants. These very exalted individuals are specially trained in college, and have practiced auditing companies for a number of years. In addition, they have passed a series of exams testing their clear understanding of both accounting principles and auditing procedures. Note that FASB is made up mostly of CPAs and that CPAs both develop, interpret and apply GAAP when they audit a company. All this is fairly incestuous.

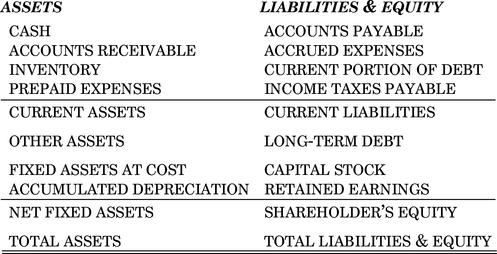

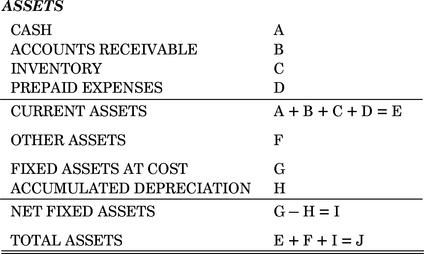

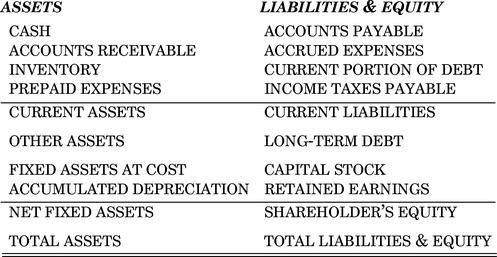

Chapter 2. The Balance Sheet

One of the two main financial statements of a business…

the other is the Income Statement.

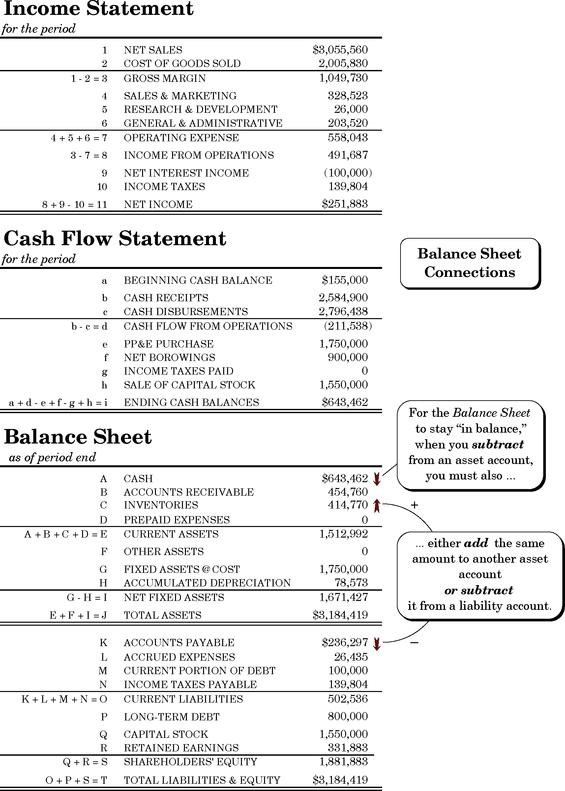

The Basic Equation of Accounting

• The basic equation of accounting states: “What you have minus what you owe is what you’re worth.”

• Worth, net worth, equity, owners’ equity and shareholders’ equity all mean the same thing—the value of the enterprise belonging to its owners.

The Balance Sheet

• The Balance Sheet presents the basic equation of accounting in a slightly rearranged form:

• By definition, this equation must always be “in balance” with assets equaling the sum of liabilities and worth.

• So, if you add an asset to the left side of the equation, you must also increase the right side by adding a liability or increasing worth. Two entries are required to keep the equation in balance.

Balance Sheet Format

as of a specific date

The Balance Sheet—a snapshot in time.

• The Balance Sheet presents the financial picture of the enterprise on one particular day, an instant in time, the date it was written.

• The Balance Sheet presents:

what the enterprise has today: assets

how much the enterprise owes today: liabilities

what the enterprise is worth today: equity

• The Balance Sheet reports:

Balance Sheet Format

as of a specific date

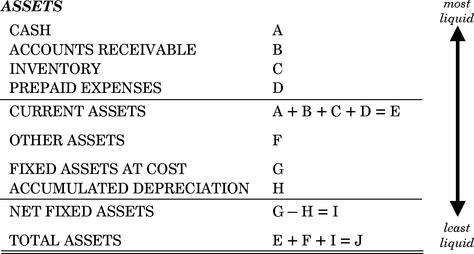

What are Assets?

• Assets are everything you’ve got—cash in the bank, inventory, machines, buildings—all of it.

• Assets are also certain “rights” you own that have a monetary value…like the right to collect cash from customers who owe you money.

• Assets are valuable and this value must be quantifiable for an asset to be listed on the Balance Sheet. Everything in a company’s financial statements must be translated into dollars and cents.

Balance Sheet Format

as of a specific date

Grouping Assets for Presentation

• Assets are grouped for presentation on the Balance Sheet according to their characteristics:

very liquid assets ….. cash and securities

productive assets ….. plant and machinery

assets for sale ………. inventory

• Accounts receivable are a special type of asset group —the obligations of customers of a company to pay the company for goods shipped to them on credit.

• Assets are displayed in the asset section of the Balance Sheet in the descending order of liquidity (the ease of convertibility into cash). Cash itself is the most liquid of all assets; fixed assets are normally the least liquid.

Balance Sheet Format

as of a specific date

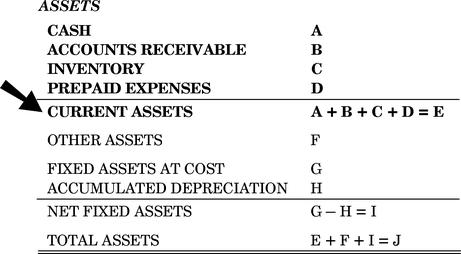

Current Assets

By definition, current assets are those assets that are expected to be converted into cash in less than 12 months.

• Current asset groupings are listed in order of liquidity with the most easy to convert into cash listed first:

• The money the company will use to pay its bills in the near term (within the year) will come when its current assets are converted into cash (that is, inventory is sold and accounts receivable are then paid to the company by customers).

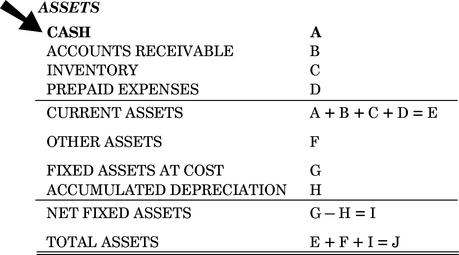

Current Assets: Cash

• Cash is the ultimate liquid asset: on-demand deposits in a bank as well as the dollars and cents in the petty cash drawer.

• When you write a check to pay a bill, you are taking money out of cash assets.

• Like all the rest of the Balance Sheet, cash is denominated in U.S. dollars for corporations in the United States. A U.S. company with foreign subsidiaries would convert the value of any foreign currency it holds (and also other foreign assets) into dollars for financial reporting.

Balance Sheet Format

as of a specific date

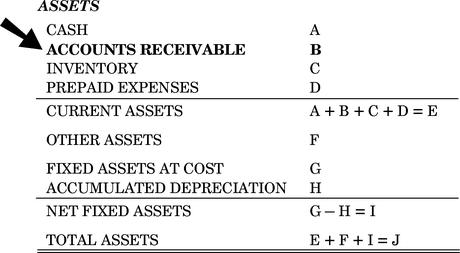

Current Assets: Accounts Receivable

• When the enterprise ships a product to a customer on credit, the enterprise acquires a right to collect money from that customer at a specified time in the future.

• These collection rights are totaled and reported on the Balance Sheet as accounts receivable.

• Accounts receivable are owed to the enterprise from customers (called “accounts”) who were shipped goods but have not yet paid for them. Credit customers—most business between companies is done on credit—are commonly given payment terms that allow 30 or 60 days to pay.

Balance Sheet Format

as of a specific date

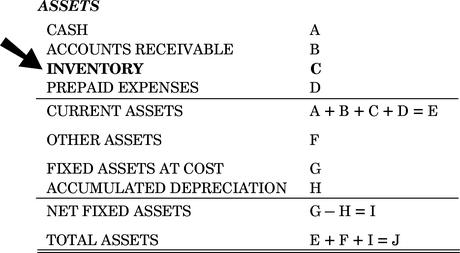

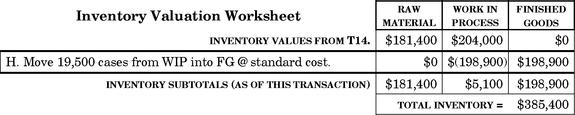

Current Assets: Inventory

• Inventory is both finished products for ready sale to customers and also materials to be made into products. A manufacturer’s inventory includes three groupings:

1. Raw material inventory is unprocessed materials that will be used in manufacturing products.

2. Work-in-process inventory is partially finished products in the process of being manufactured.

3. Finished goods inventory is completed products ready for shipment to customers when they place orders.

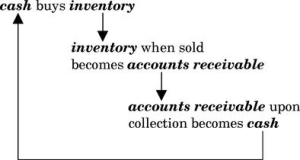

• As finished goods inventory is sold it becomes an accounts receivable and then cash when the customer pays.

Balance Sheet Format

as of a specific date

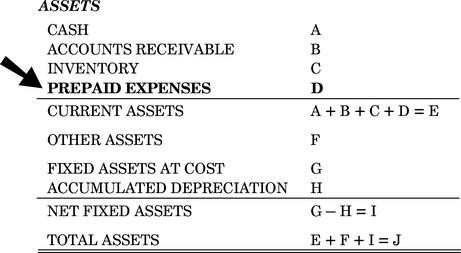

Current Assets: Prepaid Expenses

• Prepaid expenses are bills the company has already paid…but for services not yet received.

• Prepaid expenses are things like prepaid insurance premiums, prepayment of rent, deposits paid to the telephone company, salary advances, etc.

• Prepaid expenses are current assets not because they can be turned into cash, but because the enterprise will not have to use cash to pay them in the near future. They have been paid already.

Current Asset Cycle

• Current assets are said to be “working assets” because they are in a constant cycle of being converted into cash. The repeating current asset cycle of a business is shown below:

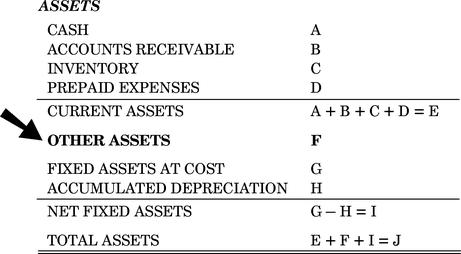

More asset types

• In addition to a company’s current assets, there are two other major asset groups listed on the Balance Sheet: Other assets and fixed assets. These so-called “non-current assets” are not converted into cash during the normal course of business.

• Other assets is a catchall category that includes intangible assets such as the value of patents, trade names and so forth.

• The company’s fixed assets (so-called property, plant and equipment, or PP&E) is generally the largest and most important non-current asset grouping.

Balance Sheet Format

as of a specific date

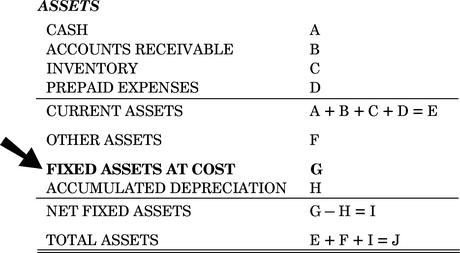

Fixed Assets at Cost

• Fixed assets are productive assets not intended for sale. They will be used over and over again to manufacture the product, display it, warehouse it, transport it and so forth.

• Fixed assets commonly include land, buildings, machinery, equipment, furniture, automobiles, trucks, etc.

• Fixed assets at cost are reported on the Balance Sheet at original purchased price. Fixed assets are also show as net fixed assets—valued at original cost minus an allowance for depreciation. See the depreciation discussion following.

Balance Sheet Format

as of a specific date

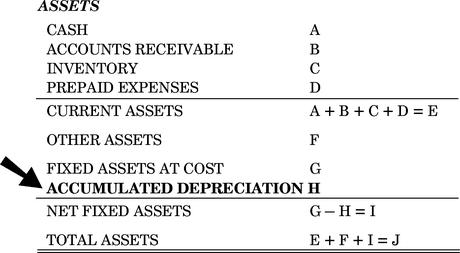

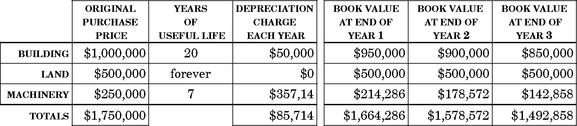

Depreciation

• Depreciation is an accounting convention reporting (on the Income Statement) the decline in useful value of a fixed asset due to wear and tear from use and the passage of time.

• “Depreciating” an asset means spreading the cost to acquire the asset over the asset’s whole useful life. Accumulated depreciation (on the Balance Sheet) is the sum of all the depreciation charges taken since the asset was first acquired.

• Depreciation charges taken in a period do lower profits for the period, but do not lower cash. Cash was required to purchase the fixed asset originally.

Balance Sheet Format

as of a specific date

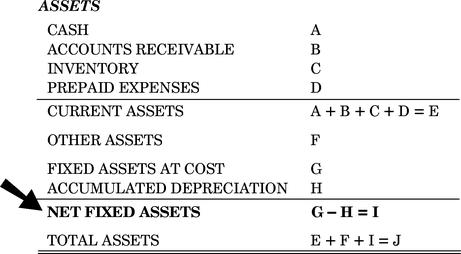

Net Fixed Assets

• The net fixed assets of a company are the sum of its fixed assets’ purchase prices (“fixed assets @ cost”) minus the depreciation charges taken on the Income Statement over the years (“accumulated depreciation”).

• The so-called book value of an asset—its value as reported on the books of the company—is the asset’s purchase price minus its accumulated depreciation.

• Note that depreciation does not necessarily relate to an actual decrease in value. In fact, some assets appreciate in value over time. However, such appreciated assets are by convention still reported on the Balance Sheet at their lower book value.

Balance Sheet Format

as of a specific date

Other Assets

• The other asset category on the Balance Sheet includes assets of the enterprise that cannot be properly classified into current asset or fixed asset categories.

• Intangible assets (a major type of other assets) are things owned by the company that have value but are not tangible (that is, not physical property) in nature.

• For example, a patent, a copyright, or a brand name can have considerable value to the enterprise, yet these are not tangible like a machine or inventory is.

• Intangible assets are valued by management according to various accounting conventions too complex, arbitrary and confusing to be of interest here.

Balance Sheet Format

as of a specific date

What are Liabilities?

• Liabilities are economic obligations of the enterprise, such as money that the corporation owes to lenders, suppliers, employees, etc.

• Liabilities are categorized and grouped for presentation on the balance sheet by: (1) to whom the debt is owed and (2) whether the debt is payable within the year (current liabilities) or is a long-term obligation.

• Shareholders’ equity is a very special kind of liability. It represents the value of the corporation that belongs to its owners. However, this “debt” will never be repaid in the normal course of business.

Balance Sheet Format

as of a specific date

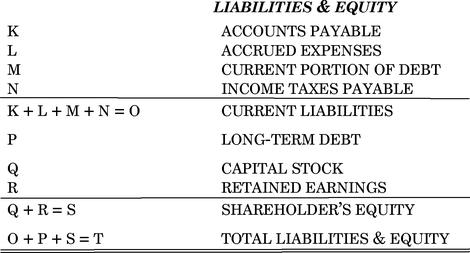

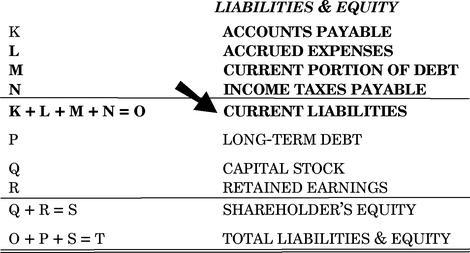

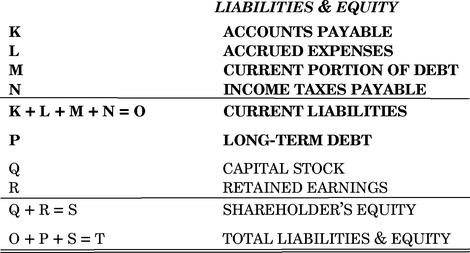

Current Liabilities

• Current liabilities are bills that must be paid within one year of the date of the Balance Sheet. Current liabilities are the reverse of current assets:

current assets…provide cash within 12 months.

current liabilities…take cash within 12 months.

• The cash generated from current assets is used to pay current liabilities as they become due.

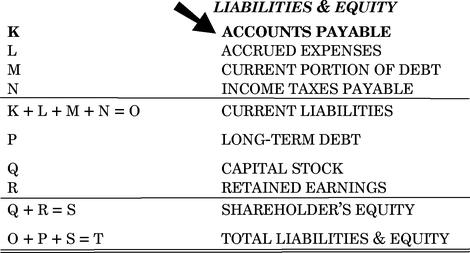

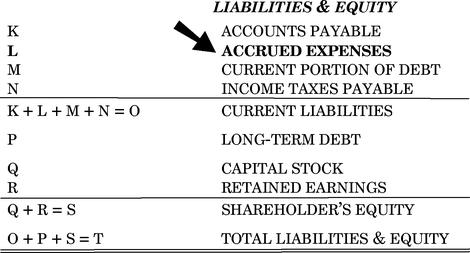

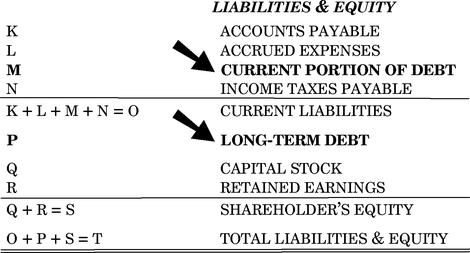

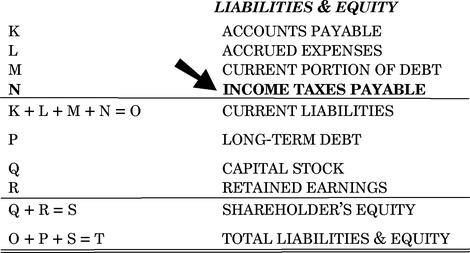

• Current liabilities are grouped depending on to whom the debt is owed: (1) accounts payable owed to suppliers, (2) accrued expenses owed to employees and others for services, (3) current debt owed to lenders and (4) taxes owed to the government.

Balance Sheet Format

as of a specific date

Current Liabilities: Accounts Payable

• Accounts payable are bills, generally to other companies for materials and equipment bought on credit, that the corporation must pay soon.

• When it receives materials, the corporation can either pay for them immediately with cash or wait and let what is owed become an account payable.

• Business-to-business transactions are most often done on credit. Common trade payment terms are usually 30 or 60 days with a discount for early payment, such as 2% off if paid within 10 days, or the total due in 30 days (“2% 10; net 30”).

Balance Sheet Format

as of a specific date

Current Liabilities: Accrued Expenses

• Accrued expenses are monetary obligations similar to accounts payable. The business uses one or the other classification depending on to whom the debt is owed.

• Accounts payable is used for debts to regular suppliers of merchandise or services bought on credit.

• Examples of accrued expenses are salaries earned by employees but not yet paid to them, lawyers’ bills not yet paid, interest due but not yet paid on bank debt and so forth.

Balance Sheet Format

as of a specific date

Current Debt and Long-Term Debt

• Any notes payable and the current portion of long-term debt are both components of current liabilities and are listed on the Balance Sheet under current portion of debt.

• If the enterprise owes money to a bank and the terms of the loan say it must be repaid in less than 12 months, then the debt is called a note payable and is a current liability.

• A loan with an overall term of more than 12 months from the date of the Balance Sheet is called long-term debt. A mortgage on a building is a common example.

The so-called current portion of long-term debt is that amount due for payment within 12 months and is a current liability listed under current portion of debt.

Balance Sheet Format

as of a specific date

Current Liabilities: Income Taxes Payable

• Every time the company sells something and makes a profit on the sale, a percentage of the profit will be owed the government as income taxes.

• Income taxes payable are income taxes that the company owes the government but that the company has not yet paid.

• Every three months or so the company will send the government a check for the income taxes owed. For the time between when the profit was made and the time when the taxes are actually paid, the company will show the amount to be paid as income taxes payable on the Balance Sheet.

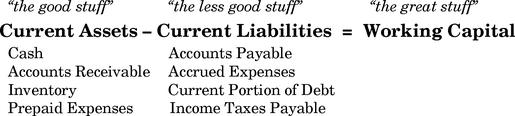

Working Capital

• The company’s working capital is the amount of money left over after you subtract current liabilities from current assets.

• Working capital is the amount of money the enterprise has to “work with” in the short-term. Working capital feeds the operations of the enterprise with dollar bills. Working capital is also called “net current assets” or simply “funds.”

Sources and Uses of Working Capital

• Sources of working capital are ways working capital increases in the normal course of business. This increase in working capital happens when:

1. current liabilities decrease and/or

2. current assets increase

• Uses of working capital (also called applications) are ways working capital decreases during the normal course of business. For example, when:

1. current assets decrease and/or

2. current liabilities increase

• With lots of working capital it will be easy to pay your “current” financial obligations…bills that come due in the next 12 months.

Balance Sheet Format

as of a specific date

Total Liabilities

• Note: There is not a separate line for total liabilities in most Balance Sheet formats.

• A company’s total liabilities are just the sum of its current liabilities and its long-term debt.

• Long-term debt is any loan to the company to be repaid more than 12 months after the date of the Balance Sheet.

• Common types of long-term debt include mortgages for land and buildings and so-called chattel mortgages for machinery and equipment.

Balance Sheet Format

as of a specific date

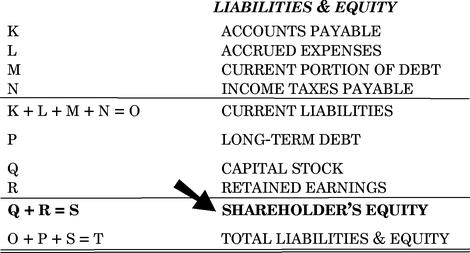

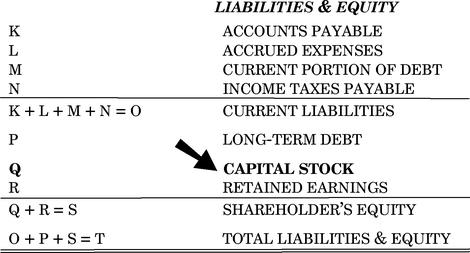

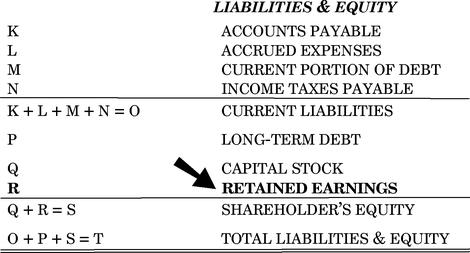

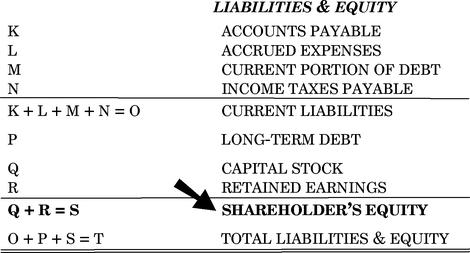

Shareholders’ Equity

• If you subtract what the company owes (total liabilities) from what it has (total assets), you are left with the company’s value to its owners…its shareholders’ equity.

• Shareholders’ equity has two components:

1. Capital stock: The original amount of money the owners contributed as their investment in the stock of the company.

2. Retained earnings: All the earnings of the company that have been retained, that is, not paid out as dividends to owners.

• Note: Both “net worth” and “book value” mean the same thing as shareholders’ equity.

Balance Sheet Format

as of a specific date

Capital Stock

• The original money to start and any add-on money invested in the business is represented by shares of capital stock held by owners of the enterprise.

• So-called common stock is the regular “denomination of ownership” for all corporations. All companies issue common stock, but they may issue other kinds of stock, too.

• Companies often issue preferred stock that have certain contractual rights or “preferences” over the common stock. These rights may include a specified dividend and/or a preference over common stock to receive company assets if the company is liquidated.

Balance Sheet Format

as of a specific date

Retained Earnings

• All of the company’s profits that have not been returned to the shareholders as dividends are called retained earnings.

retained earnings = sum of all profits – sum of all dividends

• Retained earnings can be viewed as a “pool” of money from which future dividends could be paid. In fact, dividends cannot be paid to shareholders unless sufficient retained earnings are on the Balance Sheet to cover the total amount of the dividend checks.

• If the company has not made a profit but rather has sustained losses, it has “negative retained earnings” that are called its accumulated deficit.

Balance Sheet Format

as of a specific date

Changes in Shareholders’ Equity

• Shareholders’ equity is just the sum of the investment made in the stock of the company plus any profits (less any losses) minus any dividends that have been paid to shareholders.

• The value of shareholders’ equity increases when the company: (1) makes a profit, thereby increasing retained earnings, or (2) sells new stock to investors, thereby increasing capital stock.

• The value of shareholders’ equity decreases when the company: (1) has a loss, thereby lowering retained earnings, or (2) pays dividends to shareholders, thereby lowering retained earnings.

Balance Sheet Format

as of a specific date

Balance Sheet Summary

• The Balance Sheet presents the financial picture of the enterprise on one particular day, an instant in time.

• By definition, this equation must always be in balance with assets equaling the sum of liabilities and equity.

• The Balance Sheet along with the Income Statement form the two major financial statements of the company.

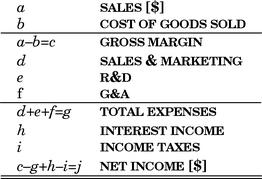

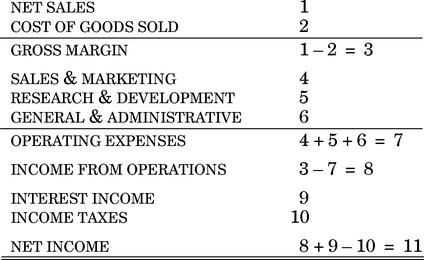

Chapter 3. The Income Statement

One of the two main financial statements

of a business…the other is the Balance Sheet.

Income Statement Format

for the period x through y

The Income Statement

• The Income Statement gives one important perspective on the health of a business—its profitability.

• Note: The Income Statement does not tell the whole picture about a company’s financial health.

The Balance Sheet reports on assets, liabilities and equity.

The Cash Flow Statement reports on cash movements.

• Also note: The Income Statement says nothing about when the company receives cash or how much cash it has on hand.

The Income Statement (continued)

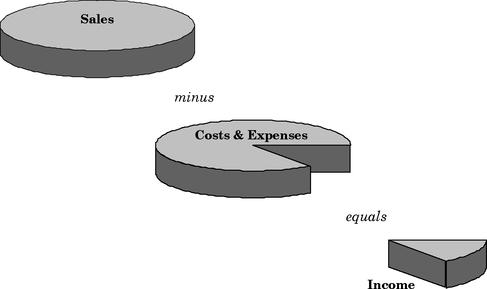

• The Income Statement reports on making and selling activities of a business over a period of time:

what’s sold in the period

minus

what it cost to make

minus

selling & general expenses for the period

equals

income for the period.

• The Income Statement documents for a specific period (a month, quarter or year) the second basic equation of accounting:

Sales – Costs & Expenses = Income

Income Statement Format

for the period x through y

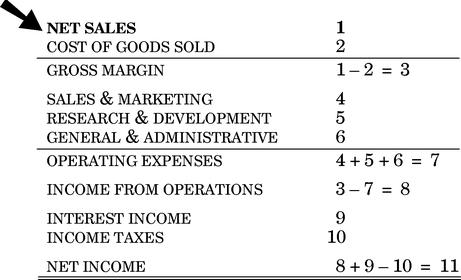

Net Sales

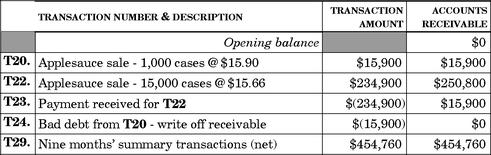

• Sales are recorded on the Income Statement when the company actually ships products to customers. Customers now have an obligation to pay for the product and the company has the right to collect.

• When the company ships a product to a customer, it also sends an invoice (a bill). The company’s right to collect is called an account receivable and is entered on the company’s Balance Sheet.

• Note: Net sales means the total amount the company will ultimately collect from a sale—that is, list price less any discounts offered to the customer to induce purchase.

Sales vs. Orders

• A sale is made when the company actually ships a product to a customer. Orders, however, are something different.

• Orders become sales only when the products ordered have left the company’s loading dock and are en route to the customer.

• When a sale is made, income is generated on the Income Statement. Orders only increase the “backlog” of products to be shipped and do not have an impact on the Income Statement in any way. Simply receiving an order does not result in income.

Costs

• Costs are expenditures for raw materials, workers’ wages, manufacturing overhead and so forth. Costs are what you spend when you buy (or make) products for inventory.

• When this inventory is sold, that is, shipped to customers, its total cost is taken out of inventory and entered in the Income Statement as a special type of expense called cost of goods sold.

• Costs lower cash and increase inventory values on the Balance Sheet. Only when inventory is sold does its value move from the Balance Sheet to the Income Statement as cost of goods sold.

Income Statement Format

for the period x through y

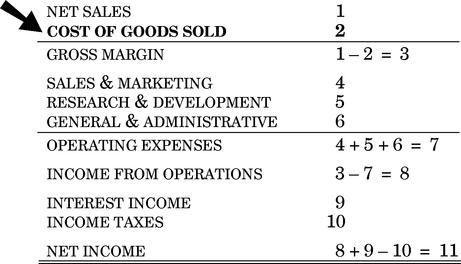

Cost of Goods Sold

• When a product is shipped and a sale is booked, the company records the total cost of manufacturing the product as cost of goods sold on the Income Statement.

• Remember: When the company made the product, it took all the product’s costs and added them to the value of inventory.

• The costs to manufacture products are accumulated in inventory until the products are sold. Then these costs are “expensed” through the Income Statement as cost of goods sold.

Income Statement Format

for the period x through y

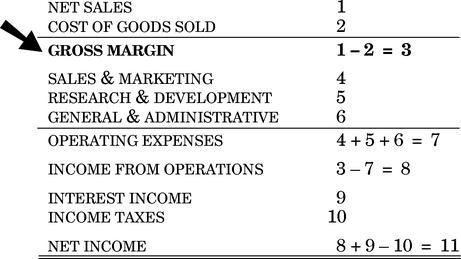

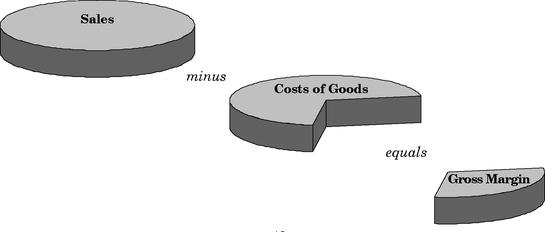

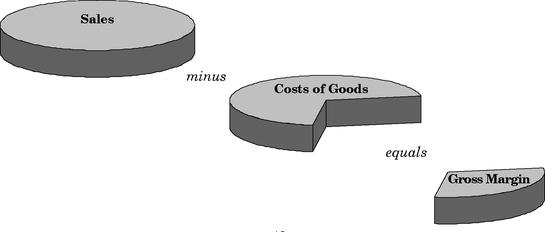

Gross Margin

• Gross margin is the amount left over from sales after product manufacturing costs (cost of goods sold) are subtracted. Gross margin is sometimes called gross profit or the company’s manufacturing margin.

Cost vs. Expense

• Two different terms, cost and expense, are used to describe how the company spends its money:

Manufacturing expenditures to build inventories are called costs.

All other business expenditures are called expenses.

• Note: Using the terms cost and expense correctly will make it easier to understand how the Income Statement and Balance Sheet work together.

• Also note: An expenditure can be either a cost or an expense. Expenditure simply means the use of cash to pay for an item purchased.

Expenses

• Expenses pay for developing and selling products and for running the “general and administrative” aspects of the business.

• Examples of expenses are paying legal fees and a sales person’s salary, buying chemicals for the R&D laboratory and so forth.

• Expenses directly lower income on the Income Statement.

• Note: The words profit and income mean the same thing; that is, what’s left over from sales after you have subtracted all the costs and expenses.

Income Statement Format

for the period x through y

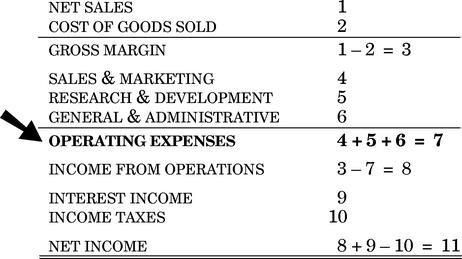

Operating Expenses

• Operating expenses are those expenditures (that is, cash out) that a company makes to generate income.

• Common groupings of operating expense are:

1. Sales & Marketing expense.

2. Research & Development (“R&D”) expenses.

3. General & Administrative (“G&A”) expenses.

• Operating expenses are also called SG&A expenses, meaning “sales, general and administrative expenses.”

Income or (Loss)

• If sales exceed costs plus expenses (as reported on the Income Statement), the business has earned income. If costs plus expenses exceed sales, then a loss has occurred.

• The terms income and profit and earnings all have the same meaning—what’s left over when you subtract expenses and costs from sales.

Note: The Income Statement is often referred to as the Profit & Loss Statement, the Earnings Statement, or simply the P&L.

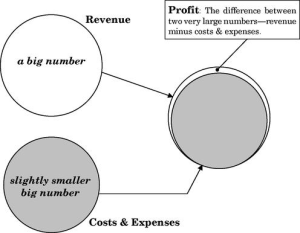

• Remember: Income is the difference between two very large numbers: sales less costs and expenses. Slightly lower sales and/or slightly higher costs and expenses can eliminate any expected profit and result in a loss.

Income Statement Format

for the period x through y

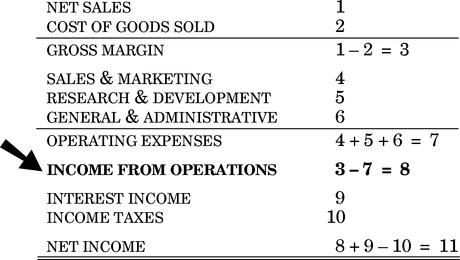

Income From Operations

• A manufacturing company’s operations are all its actions taken in making and selling products, resulting in both expenses and costs. The term income from operations refers to what is left over after expenses and costs are subtracted from sales.

• Note: Companies can also generate income and have expenses from financial (non-operating) activities. For example, a manufacturing company selling a piece of real estate for a profit.

Income Statement Format

for the period x through y

Non-operating Income & Expense

• Paying interest on a loan is a so-called non-operating expense. Likewise, receiving interest on cash balances in the company’s bank account is non-operating income.

• Because it is from non-operating sources, interest income (or expense) is reported on the Income Statement just below the Income from Operations line. Likewise taxes.

• Note: A company’s operations can be producing income, but the company as a whole can still show an overall loss. This sad state of affairs comes about when non-operating expenses (such as very high interest expenses) exceed the total operating income.

Income Statement Format

for the period x through y

Net Income

• Income is the difference between two large numbers: (1) sales and (2) costs plus expenses. More costs plus expenses than sales and the company will show a loss. Less costs plus expenses than sales and the company will show a profit.

• Remember: Income is not cash. In fact, a very profitable company with lots of net income can also be insolvent; that is, with no cash left to pay its bills.

• Often rapidly growing companies are short of cash—even though they are highly profitable. They simply cannot supply out of earnings the capital required for such rapid growth.

Income Statement Format

for the period x through y

Income (Profits) vs. Sales (Revenue)

• The words income and revenue are often confused. They mean very different things:

Profit and income do mean the same thing.

Sales and revenue do mean the same thing.

• Income (also called profits) is at the BOTTOM of the Income Statement. Sales (also called revenue) is at the TOP of the Income Statement.

• Income is often referred to as the bottom line because it is the last line of the Income Statement.

• Sales are often referred to as the top line because it is at the top of the Income Statement.

Income Statement Format

for the period x through y

Income Statement Summary

• The Income Statement summarizes and displays the financial impact of:

movement of goods to customers (sales)

minus

efforts to make and sell those goods (costs and expenses)

equals

any value created in the process (income)

• All business activities that generate income or result in a loss for a company—that is, all transactions that change the value of shareholders’ equity—are recorded on the Income Statement.

Accrual Basis vs. Cash Basis

• The two major ways of running a company’s books—cash basis or accrual basis—differ on when the company records expenses and income.

• If income is measured when cash is received and expenses are measured when cash is spent, the business is said to be operating on a cash basis—just like your checkbook.

• If income and expenses are measured when the transactions occur—regardless of the physical flow of cash—the business is said to be operating on an accrual basis. More later.

Cash Basis

• Cash basis books are the simplest…functioning just like the proverbial cookie jar. When the books are on a cash basis, accounting transactions are triggered only by the movement of cash.

• With the books on a cash basis, the Income Statement and the Cash Flow Statement are the same.

• In general, people run their lives on a cash basis, but most businesses run their books on an accrual basis. All businesses that maintain inventories of product for sale must use accrual accounting to report income—so says the IRS.

Accrual Basis

• In accrual basis accounting, the Income Statement does not reflect the movement of cash, but rather, the generation of obligations (payables) to pay cash in the future.

• With accrual basis accounting, expenses occur when the company incurs the obligation to pay, not when it actually parts with the cash. In accrual basis accounting, sales and costs are recorded when the goods are shipped and customers incur the obligation to pay, not when they actually pay.

• For example, under accrual basis accounting you would lower your net worth when you use your charge card rather than when you ultimately paid the bill.

Income Statement & Balance Sheet

• The enterprise’s Income Statement and Balance Sheet are inexorably linked:

If the enterprise’s Income Statement shows income, then retained earnings are increased on the Balance Sheet.

Then, also, either the enterprise’s assets must increase or its liabilities decrease for the Balance Sheet to remain in balance.

• Thus, the Income Statement shows for a period all the actions taken by the enterprise to either increase assets or decrease liabilities on the Balance Sheet.

Chapter 4. The Cash Flow Statement

Where the company gets cash,

and where that cash goes

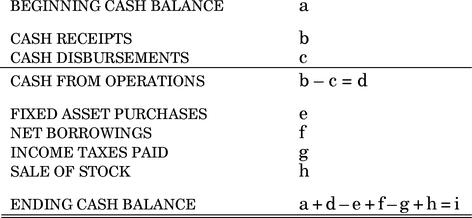

Cash Flow Statement Format

for the period x through y

Cash Flow Statement

• The Cash Flow Statement tracks the movement of cash through the business over a period of time.

• A company’s Cash Flow Statement is just like a check register…recording all the company’s transactions that use cash (checks) or supply cash (deposits).

• The Cash Flow Statement shows:

cash on hand at the start of a period

plus

cash received in the period

minus

cash spent in the period

equals

cash on hand at the end of the period.

Cash Transactions

• So-called cash transactions affect cash flow. For example:

Paying salaries lowers cash.

Paying for equipment lowers cash.

Paying off a loan lowers cash.

Receiving money borrowed from a bank raises cash.

Receiving money from investors for stock raises cash.

Receiving money from customers raises cash.

• Notice the use of the words “paying” and “receive money” in those transactions where cash actually changes hands.

Non-cash Transactions

• So-called non-cash transactions are company activities where no cash moves into or out of the company’s accounts. Non-cash transactions have no effect on the Cash Flow Statement but they can affect the Income Statement and Balance Sheet.

• Examples of non-cash transactions include: shipping product to a customer, receiving supplies from a vendor and receiving raw materials required to make the product. For these material transfer transactions, no cash actually changes hands during the transaction proper, only later.

• Note: Cash comes into the company when the customer pays for the product, not when the company ships it. Cash moves out of the company when it pays for materials, not when the company orders or receives them.

Cash Flow

• A positive cash flow for a period means the company has more cash at the end of the period than at the beginning.

• A negative cash flow for a period means that the company has less cash at the end of the period than at the beginning.

• If a company has a continuing negative cash flow, it runs the risk of running out of cash and not being able to pay its bills when due—just another way of saying:

broke…tapped-out…insolvent.

Sources and Uses of Cash

• Cash comes into the business (sources) in two major ways:

1. Operating activities such as receiving payment from customers.

2. Financing activities such as selling stock or borrowing money.

• Cash goes out of the business (uses) in four major ways:

1. Operating activities such as paying suppliers and employees.

2. Financial activities such as paying interest and principal on debt or paying dividends to shareholders.

3. Making major capital investments in long-lived productive assets like machines.

4. Paying income taxes to the government.

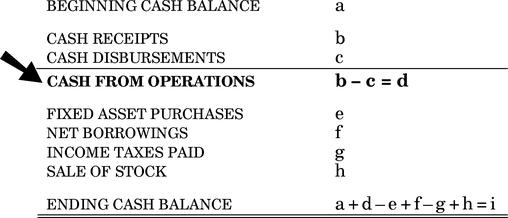

Cash Flow Statement Format

for the period x through y

Cash from Operations

• The normal day-to-day business activities (making and selling product) of a business are called its operations.

• The Cash Flow Statement shows cash from operations separately from other cash flows.

• Cash receipts are inflows of money coming from operating the business.

• Cash disbursements are outflows of money used in operating the business.

• Cash receipts (money in) minus cash disbursements (money out) equals cash from operations.

Cash Flow Statement Format

for the period x through y

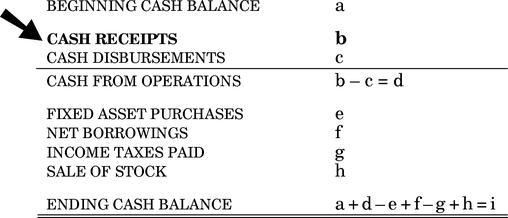

Cash Receipts

• Cash receipts (also called collections or simply receipts) come from collecting money from customers.

• Cash receipts increase the amount of cash the company has on hand.

Note: Receiving cash from customers decreases the amount that is due the company as accounts receivable shown on the Balance Sheet.

• Cash receipts are not profits. Profits are something else altogether. Don’t confuse the two. Profits are reported on the Income Statement.

Cash Flow Statement Format

for the period x through y

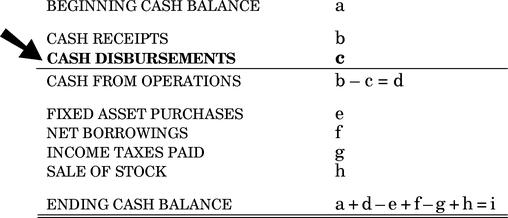

Cash Disbursements

• A cash disbursement is writing a check to pay for the rent, for inventory and supplies or for a worker’s salary. Cash disbursements lower the amount of cash the company has on hand.

• Cash disbursements (payments) to suppliers lower the amount the company owes as reported in accounts payable on the Balance Sheet.

• Cash disbursements are also called payments or simply disbursements.

Other elements of cash flow

• Cash from operations reports the flow of money into and out of the business from the making and selling of products.

• Cash from operations is a good measure of how well the enterprise is doing in its day-to-day business activities, its so-called operations.

• But remember, cash from operations is just one of the important elements of cash flow. Other major cash flows are:

1. Investment in fixed assets such as buying a manufacturing facility and machinery to make product.

2. Financial activities such as selling stock to investors, borrowing money from banks, paying dividends, or paying taxes to the government.

Cash Flow Statement Format

for the period x through y

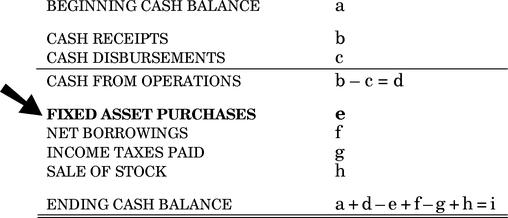

Fixed Asset Purchases

• Money spent to buy property, plant and equipment (PP&E) is an investment in the long-term capability of the company to manufacture and sell product.

• Paying for PP&E is not considered part of operations and thus is not reported in cash disbursements from operations. Cash payments for PP&E are reported on a separate line on the Cash Flow Statement. PP&E purchases are investments in productive assets.

• Needless to say, after paying for PP&E the business has less cash. Cash is used when the PP&E is purchased originally. Note, however, when the enterprise depreciates a fixed asset, it does not use any cash at that time. No check is written to anyone.

Cash Flow Statement Format

for the period x through y

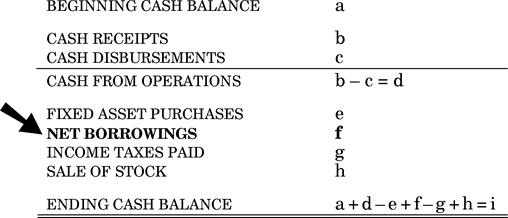

Net Borrowings

• Borrowing money increases the amount of cash the company has on hand.

• Conversely, paying back a loan decreases the company’s supply of cash on hand.

• The difference between any new borrowings in a period and the amount paid back in the period is called net borrowings. Net borrowings are reported for the period on a separate line in the Cash Flow Statement.

Cash Flow Statement Format

for the period x through y

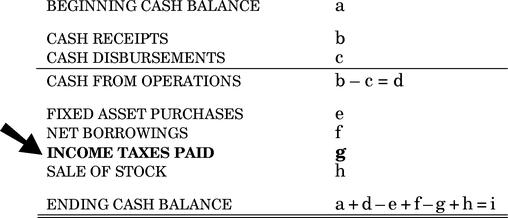

Income Taxes Paid

• Owing income taxes is different from paying them. The business owes some more income tax every time it sells something for a profit.

• But just owing taxes does not reduce cash. Only writing a check to the government and thus paying the taxes due actually reduces the company’s cash on hand.

• Paying income taxes to the government decreases the company’s supply of cash. Income taxes paid are reported on the Cash Flow Statement.

Cash Flow Statement Format

for the period x through y

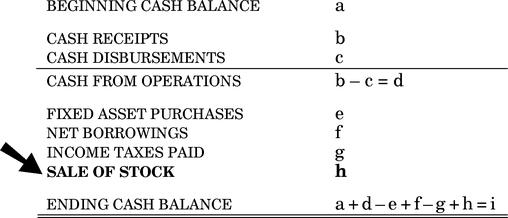

Sale of Stock: New Equity

• When people invest in a company’s stock, they exchange one piece of paper for another: real U.S. currency for a fancy stock certificate.

• When a company sells stock to investors, it receives money and increases the amount of cash it has on hand.

• Selling stock is the closest thing to printing money that a company can do…and it’s perfectly legal—unless you mislead widows and orphans as to the real value of the stock, in which case the S.E.C. (U.S. Securities and Exchange Commission) will send you to jail. Really.

Cash Flow Statement Format

for the period x through y

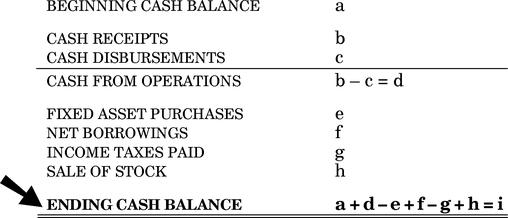

Ending Cash Balance

• The beginning cash balance (at the start of the period) plus or minus all cash transactions that took place during the period equals the ending cash balance.

• Thus:

beginning cash on hand

plus cash received

minus cash spent

equals ending cash on hand.

Cash Flow Statement Format

for the period x through y

Cash Flow Statement Summary

• Think of the company’s Cash Flow Statement as a check register reporting all the company’s payments (cash outflows) and deposits (cash inflows) for a period of time.

• If no actual cash changes hands in a particular transaction, then the Cash Flow Statement is not changed.

• Note, however, that the Balance Sheet and Income Statement may be changed by a non-cash transaction.

• Note also that cash transactions—those reported on the Cash Flow Statement—usually do have some effect on the Income Statement and Balance Sheet as well.

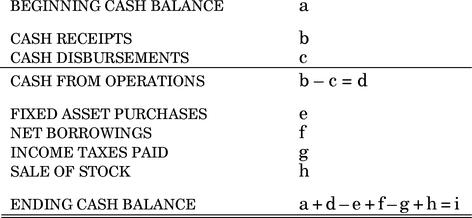

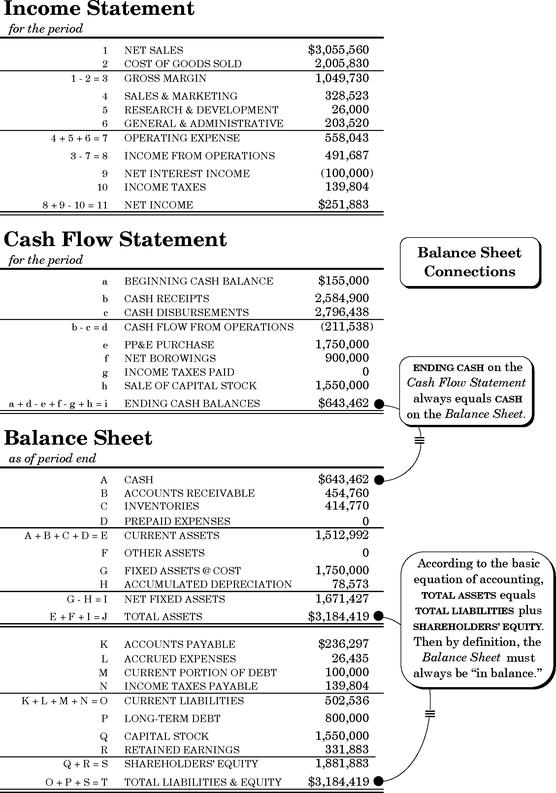

Chapter 5. Connections

These pages will begin our formal study of how the three major financial statements interact—how they work in concert to give a true picture of the enterprise’s financial health.

In the prior chapters, we studied separately the vocabulary and structure of the three main financial statements. What follows here is an opportunity to put the statements together as a financial reporting tool. We will see how the Income Statement relates to the Balance Sheet and vice versa and how changes to each can effect the Cash Flow Statement.

Remember the fundamental reporting function of each of the three main financial statements:

1. The Income Statement shows the manufacturing and selling actions of the enterprise that results in profit or loss.

2. The Cash Flow Statement details the movements of cash into and out of the coffers of the enterprise.

3. The Balance Sheet records what the company owns and what it owes, including the owner’s stake.

Each statement views the enterprise’s financial health from a different—and very necessary—perspective. And also, each statement relates to the other two. Review these examples of the natural “connections” between the three main financial statements on the following pages.

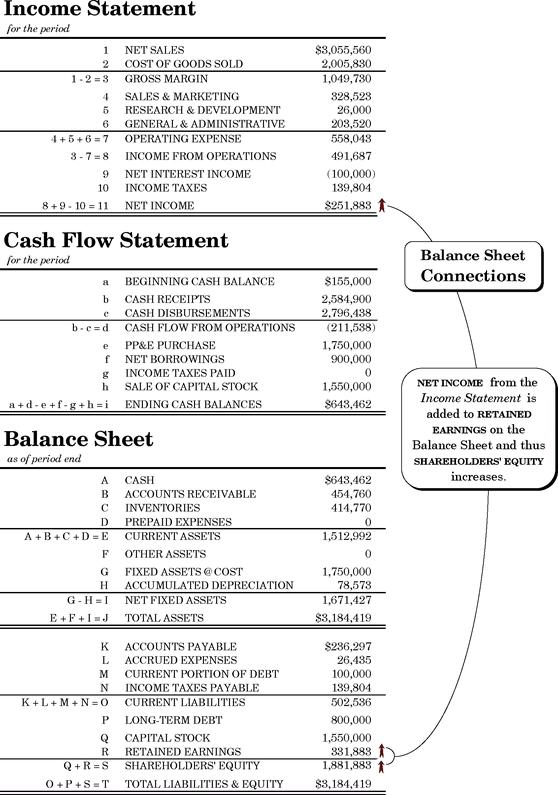

Balance Sheet Connections. First shown are several structural connections between the Balance Sheet and the other two statements.

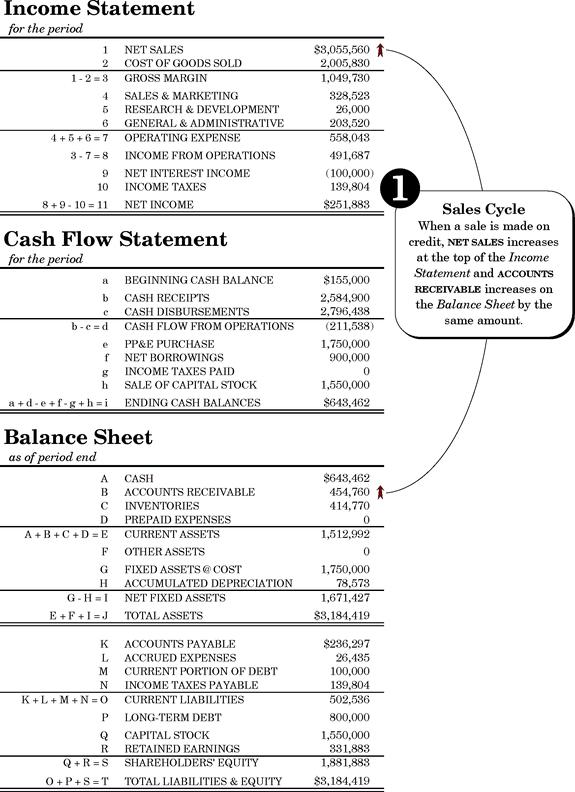

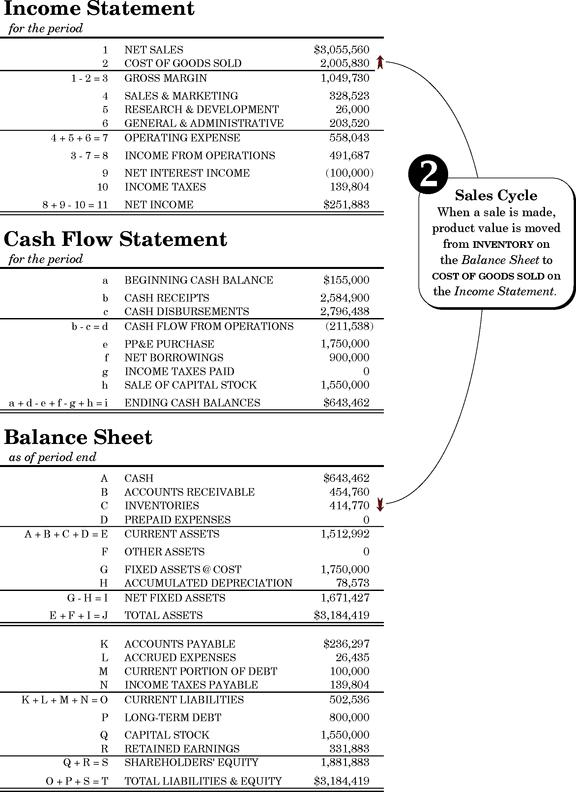

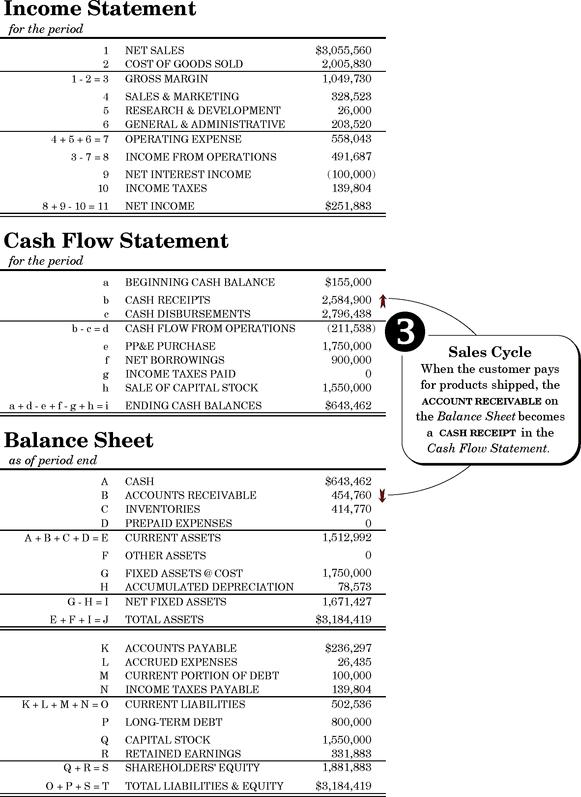

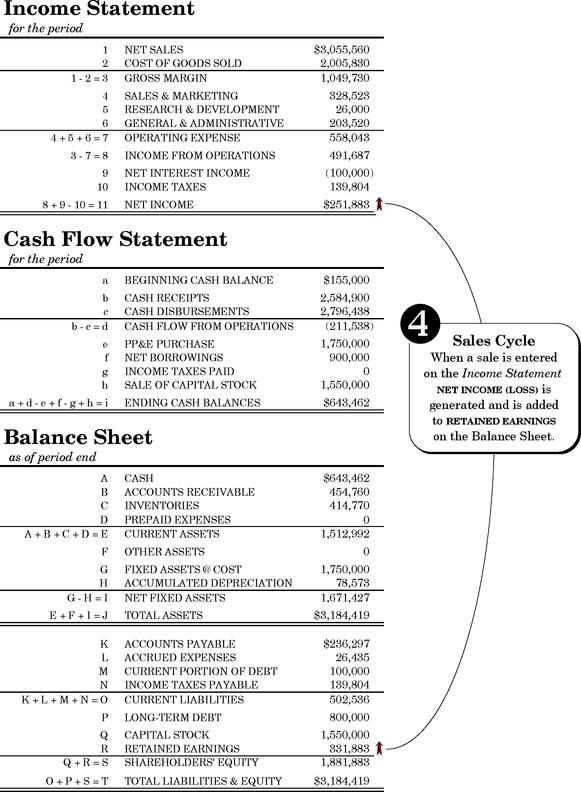

Sales Cycle. Next shown is the sale cycle describing those repeating financial statement entries that the company must make in order to report a sale and receive payment.

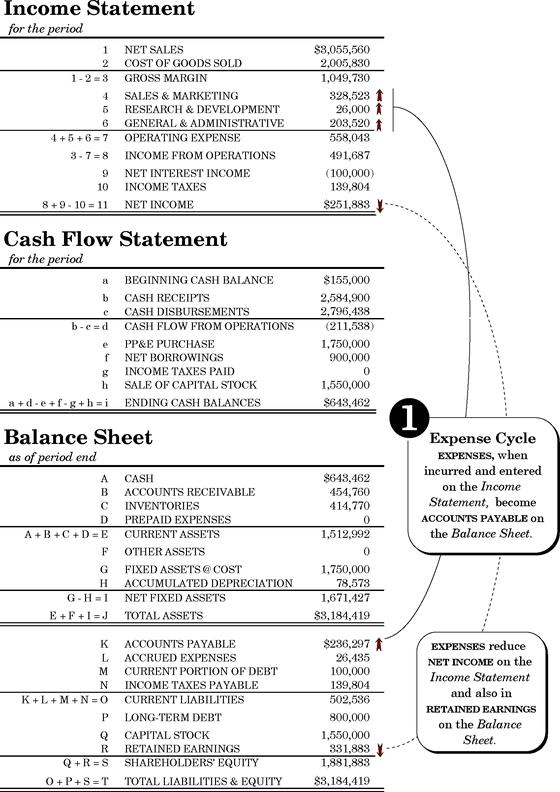

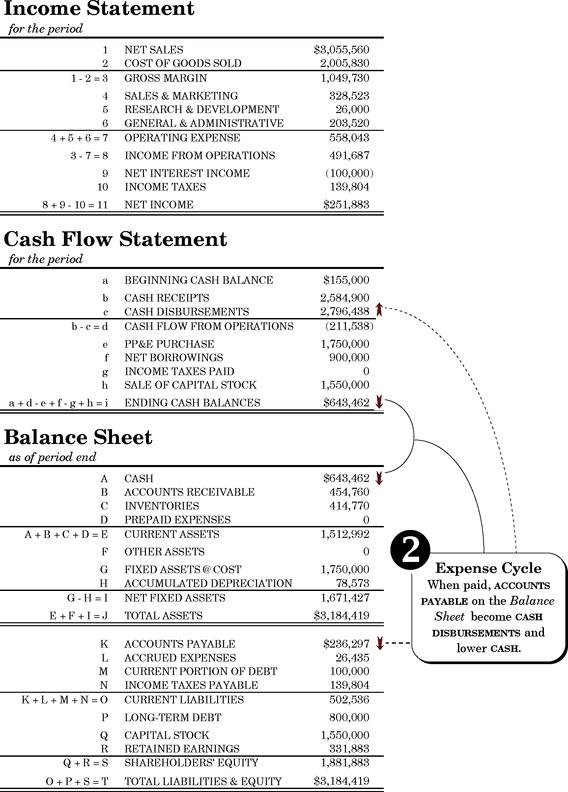

Expense Cycle. Then follows the documenting entries for SG&A expenses and their subsequent payment.

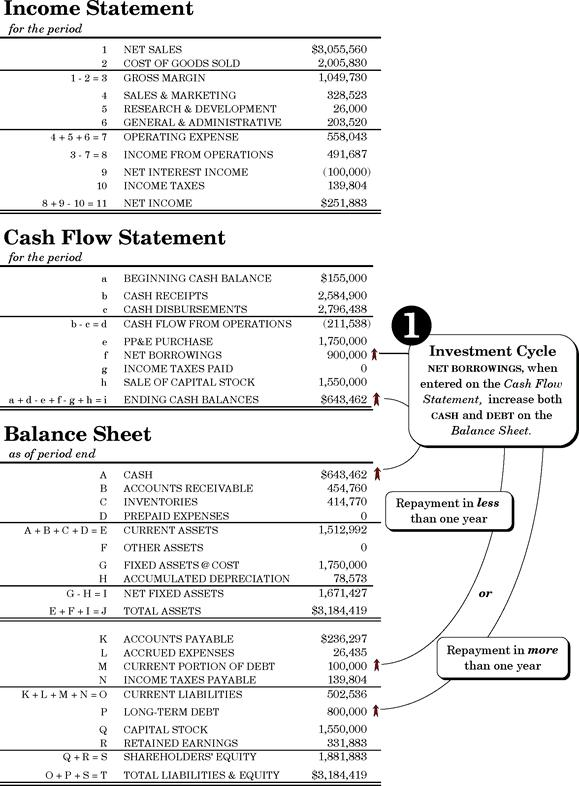

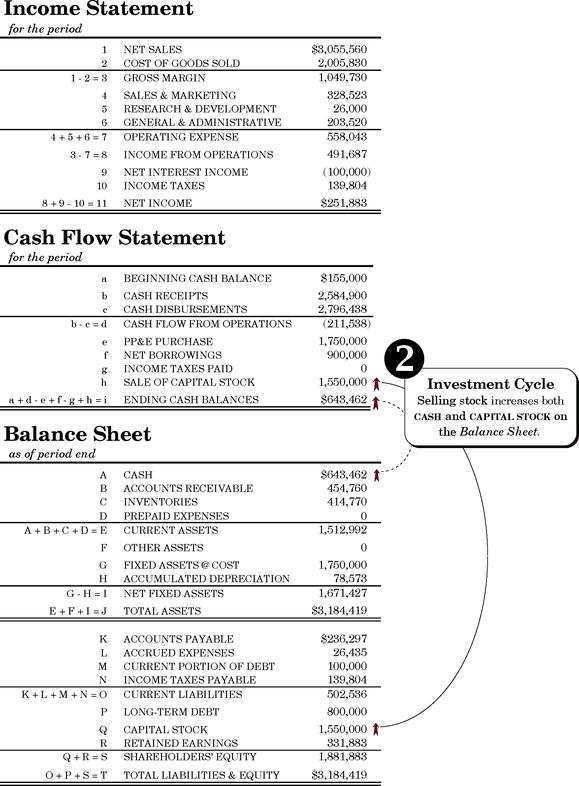

Investment Cycle. Next shown are the connection entries relating to the investment of capital and the acquisition of debt.

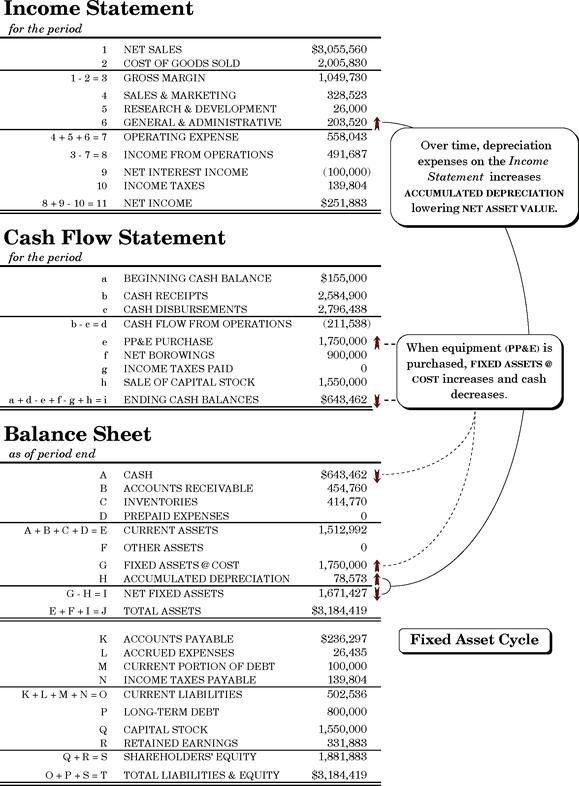

Asset Purchase/Depreciation. Last shown are entries for asset purchases and depreciation.

Here is a hint for you as you study the reporting of two things entering or leaving the business (and the statements):

1. Watch the flow of cash money.

2. Watch the flow of goods and services.

Fundamentally, the financial statements document the movement of cash and goods and services into and out of the enterprise. That is all the financial statements are about. It is no more complicated. Everything else is in the details. Don’t sweat the details.

Read on. We’re making real progress!

Financial statements document the movement of cash and goods and services into and out of the enterprise. That is all financial statements are about. It is no more complicated. Everything else is details. Don’t sweat the details.

**Section B. Transactions: Exploits of AppleSeed Enterprises, Inc.

About This Section

We are now at the heart of learning how financial statements work. In the previous section, we reviewed financial statement structure and vocabulary, and saw examples of how the three main financial statements interact.

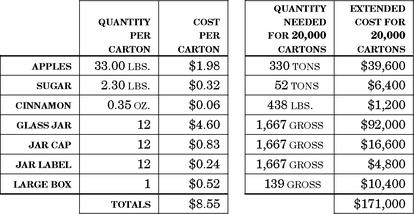

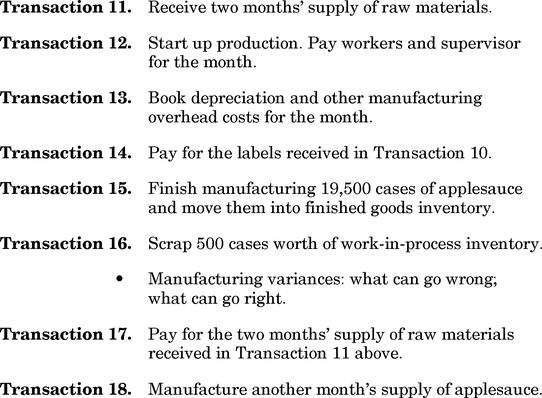

To give a real-life flavor to our study of accounting and financial reporting, we will draft the books of a hypothetical company, AppleSeed Enterprises, Inc.

The following pages chronicle 33 specific business transactions in Appleseed’s financial life. We’ll show how Appleseed constructs and maintains its books to report accurately the company’s financial position. In addition, we will discuss additional financial terms and then show examples of applying financial concepts required to keep a company’s books.

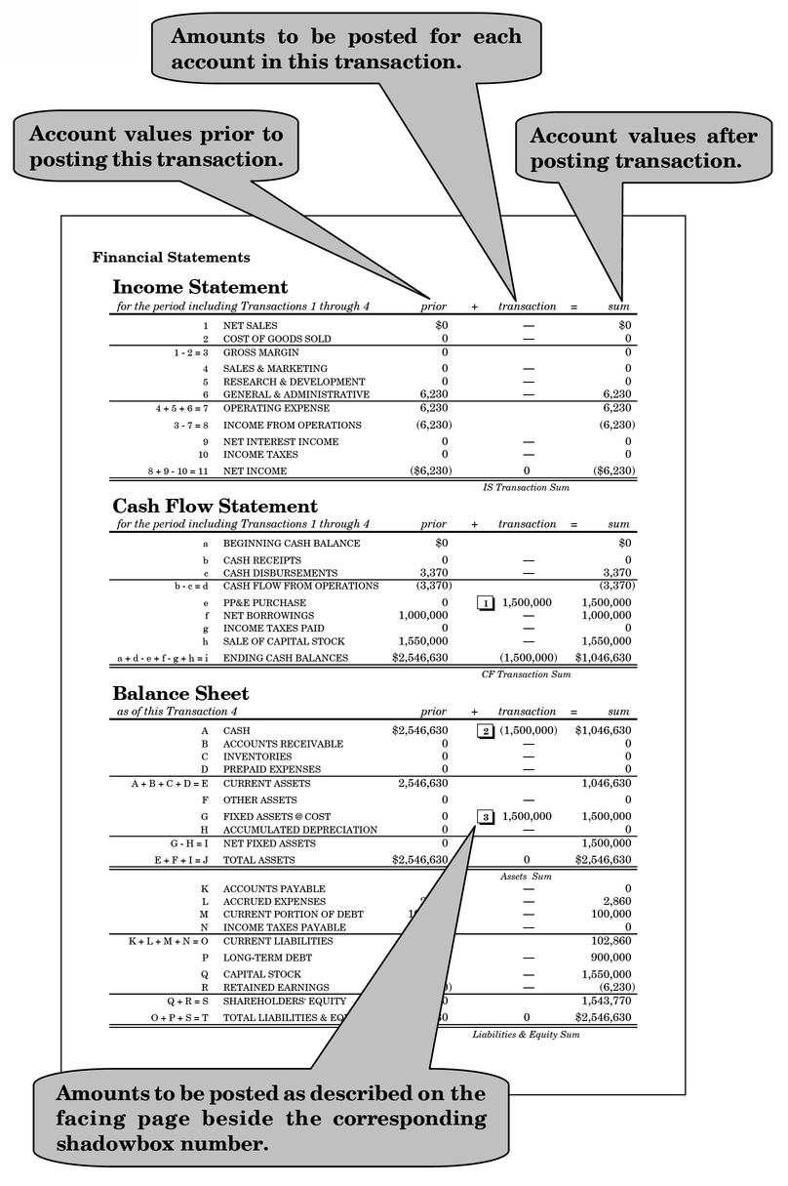

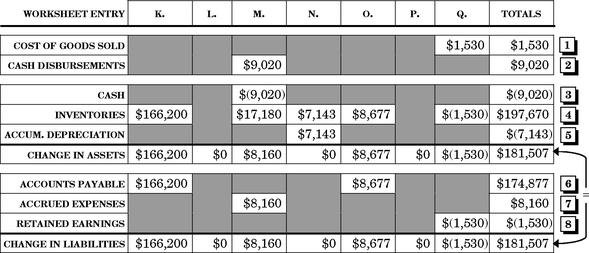

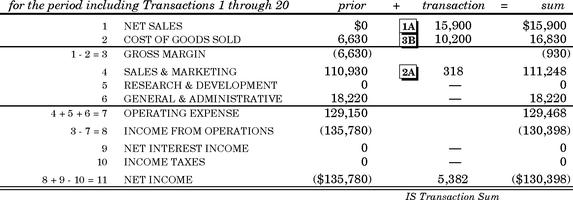

Each new business transaction means new “postings” to AppleSeed’s financial statements as our company goes about its business of making and selling delicious applesauce. As we discuss each transaction, you’ll get a hands-on feel for how a company’s books are constructed. Each transaction is described in a two-page spread. See the “annotated” transaction spread on the next two pages.

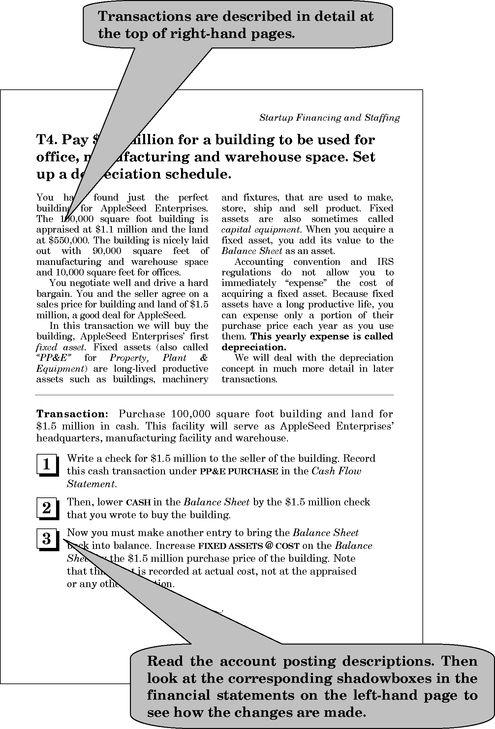

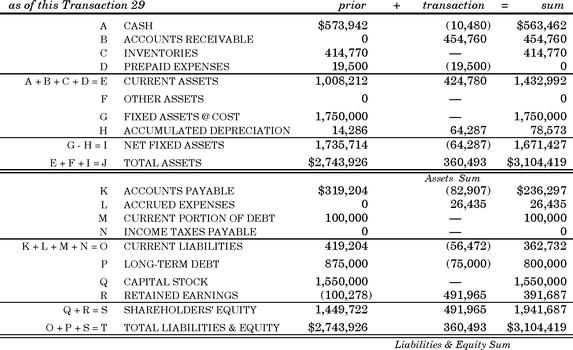

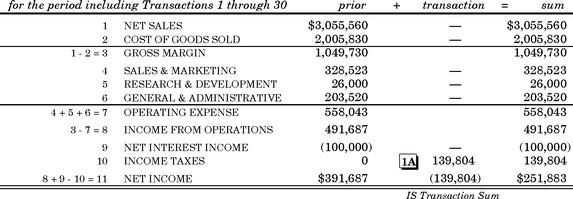

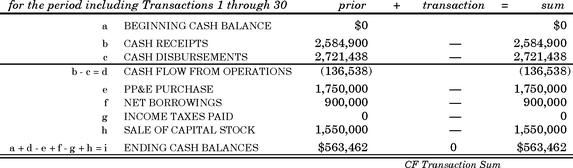

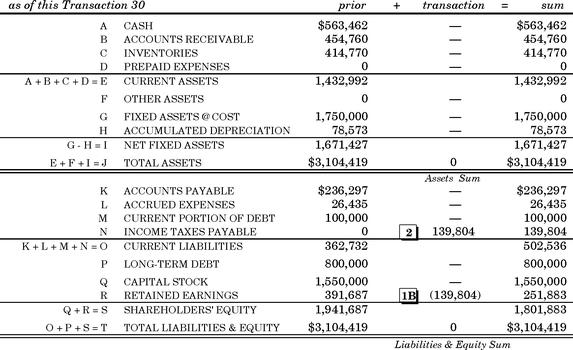

Right-Hand Page. The right-hand page of each two-page transaction spread describes an AppleSeed business transaction, discussing both business rationale and financial effect. Note that numbered shadowboxes are placed beside descriptions of specific financial postings for the transaction. These shadowboxes correspond to the entries beside the smaller numbered shadowboxes on the left-hand page showing the company’s three main financial statements.

As you begin to study each new transaction, first read and understand the right-hand page description. Then go to the left-hand page to see actual postings to AppleSeed’s three financial statements.

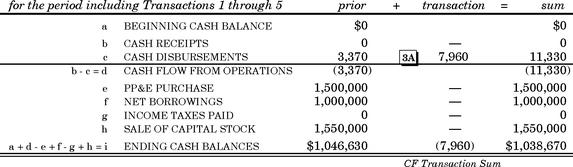

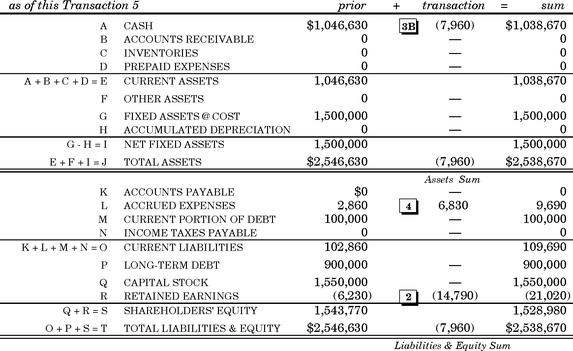

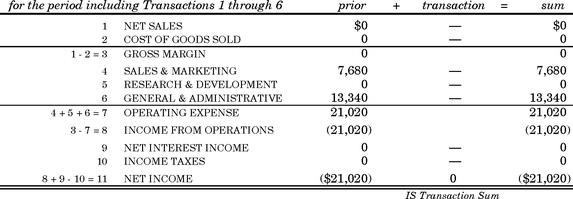

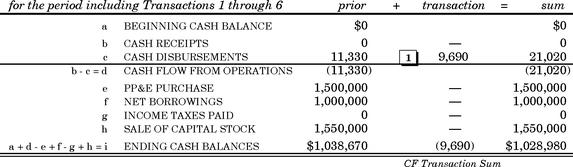

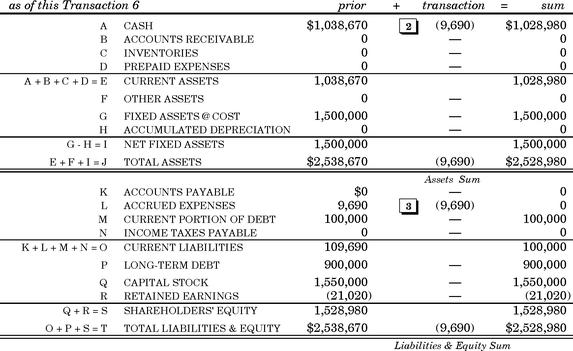

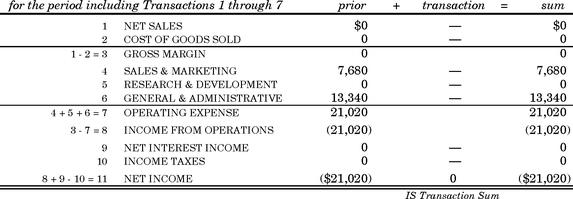

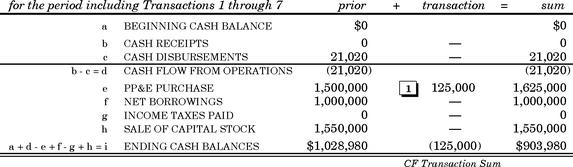

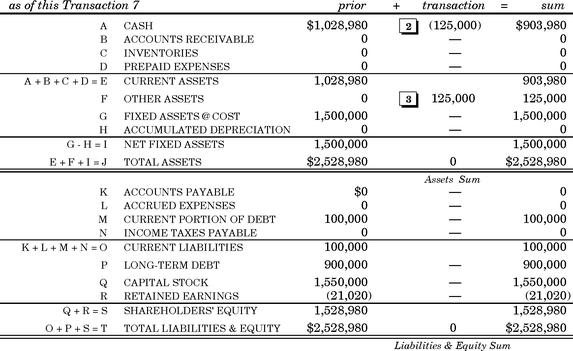

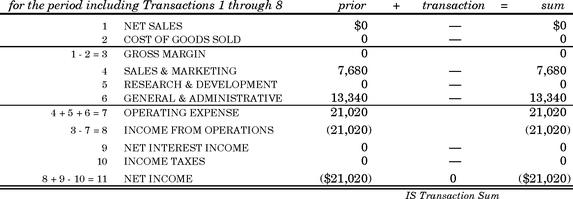

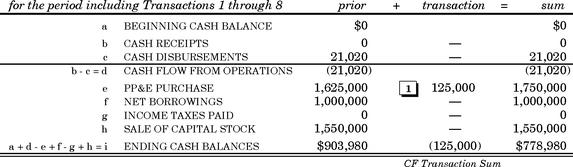

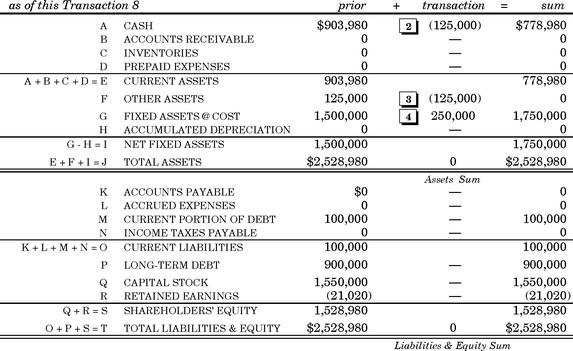

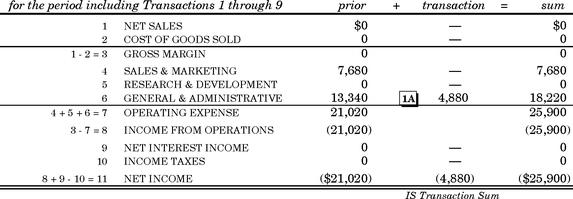

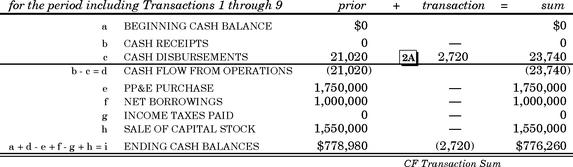

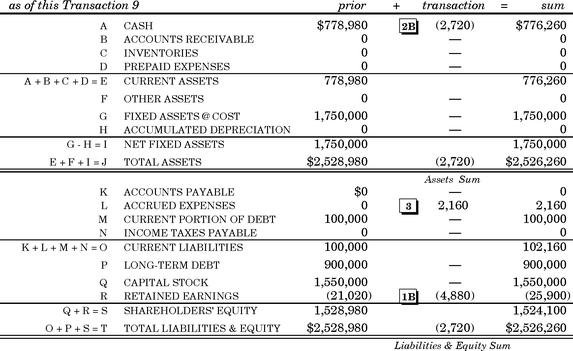

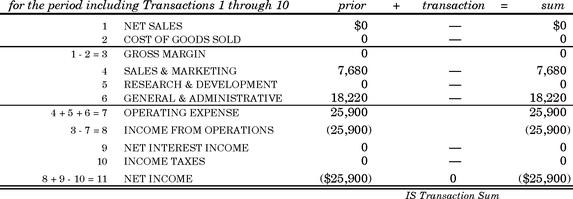

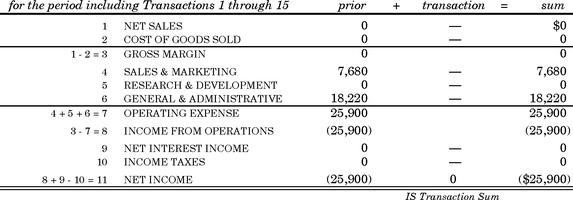

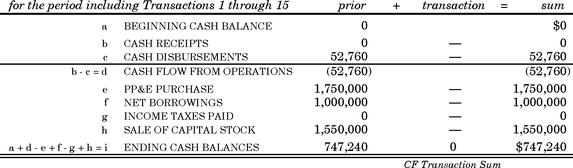

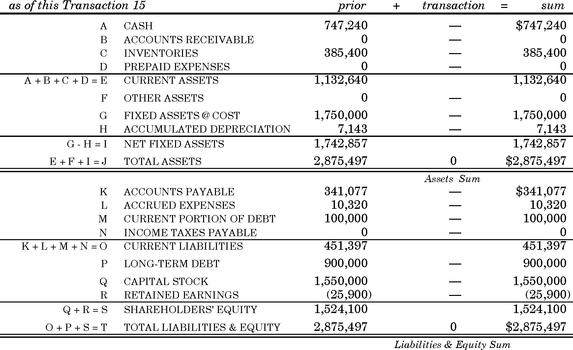

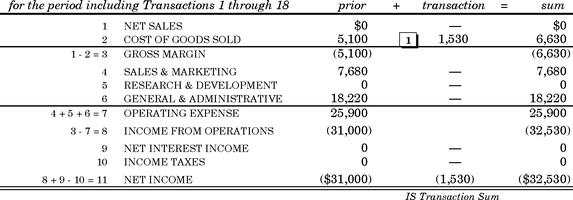

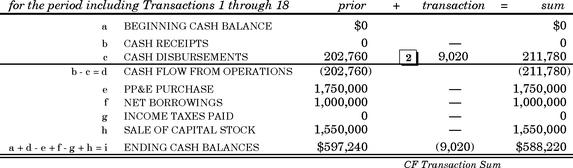

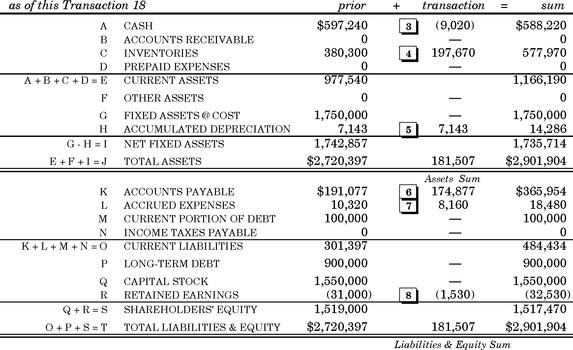

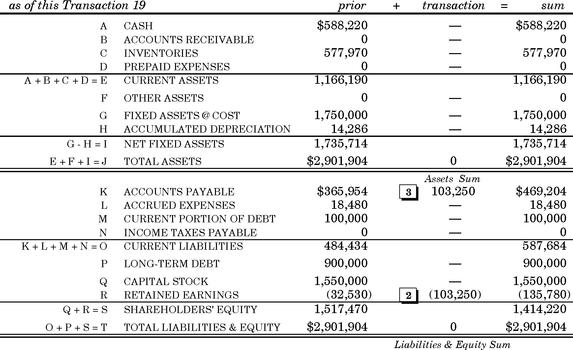

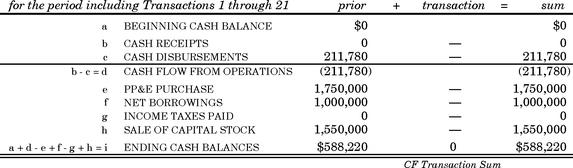

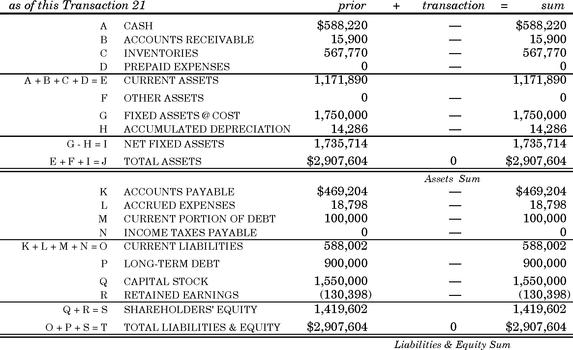

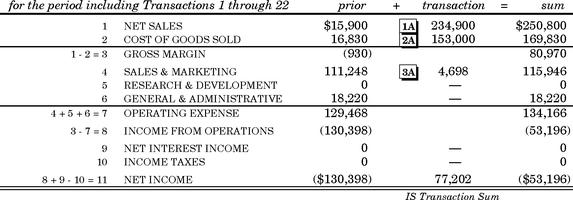

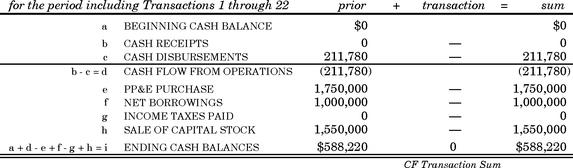

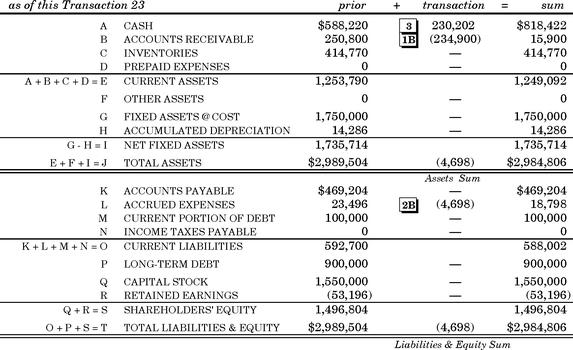

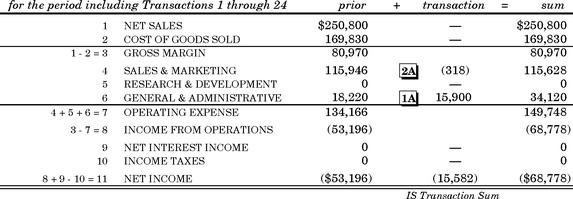

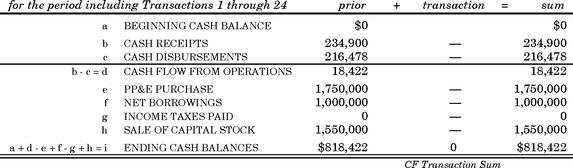

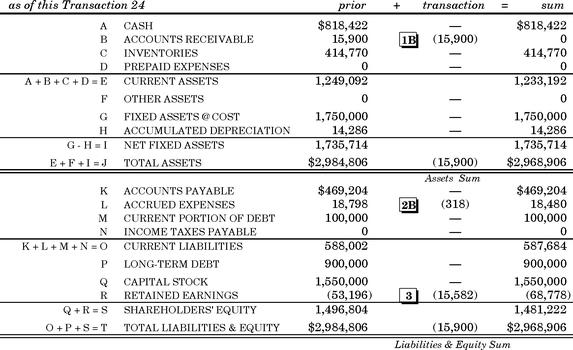

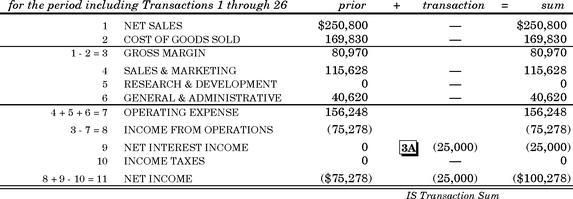

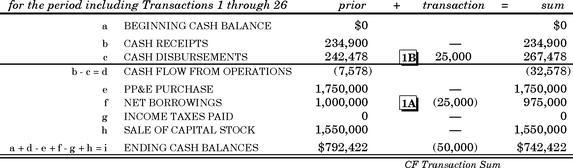

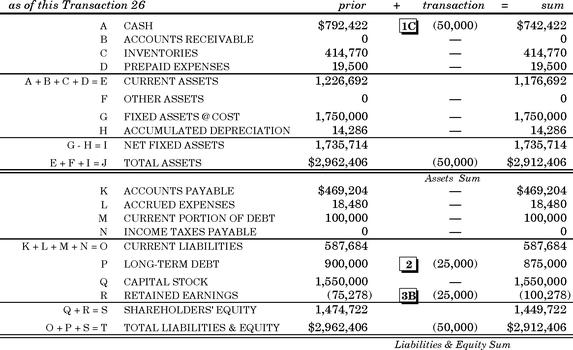

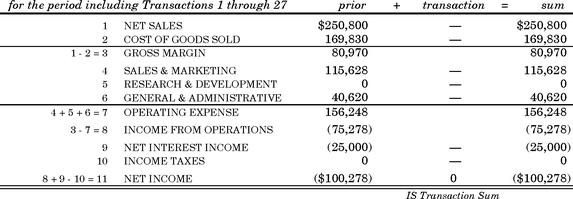

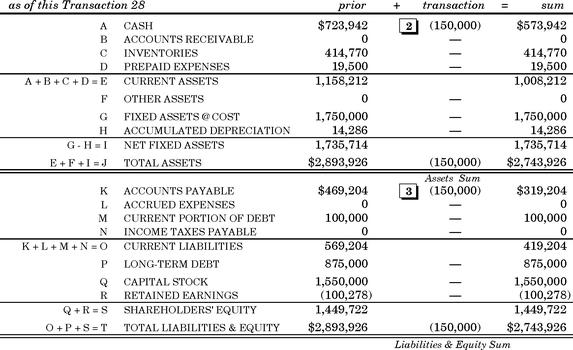

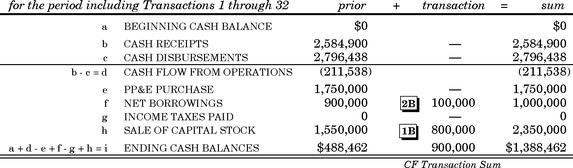

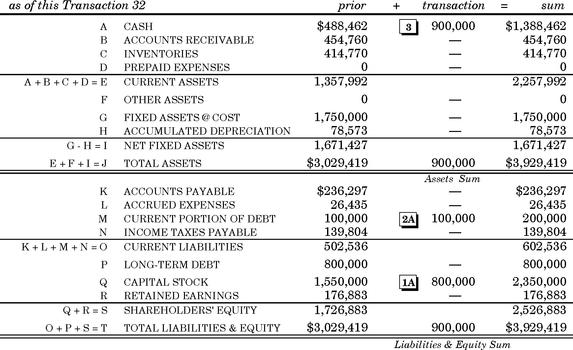

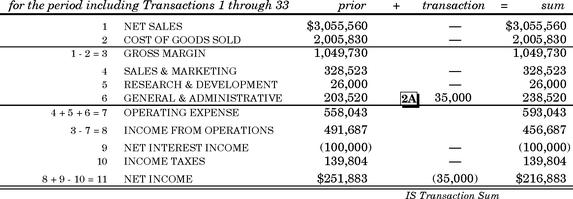

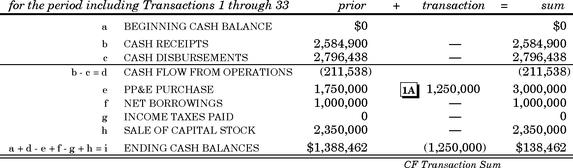

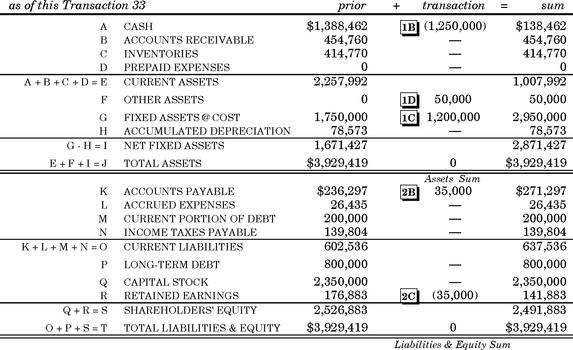

Left-Hand Page. The left-hand page of each transaction spread shows AppleSeed’s Income Statement, Balance Sheet and Cash Flow prior to the transaction and then after the transaction. Depending on the type of transaction, all three financial statements may be changed, or just two, or one or none may change.

Individual account changes are shown on left-hand pages this way:

1. The first numeric column shows all prior account values as of the last transaction.

2. The second numeric column (with small shadowboxs) shows account values posted for the transaction as described on the right-hand page.

3. The third numeric column shows the account values after the transaction has been posted, that is, after the second column numbers are added to the first.

Note these last values are those that will appear as the “prior” values for the next transaction

That is all there is to accounting and financial reporting. It is really not rocket science at all, just a little addition and subtraction. With some effort and this book, you will find enlightenment.

However, remember, our analysis is just an overview. If you need details (and there are many), just ask an accountant associate a good question based upon the knowledge you have acquired from this book. They will be so happy to get an intelligent question from a non-financial type, they will bend over backward to answer.

Welcome to AppleSeed Enterprises!

Transaction Spread Left-Hand Page

Transaction Spread Right-Hand Page

Chapter 6. Startup Financing and Staffing

Welcome to our little business—AppleSeed Enterprises, Inc. Imagine that you are AppleSeed’s entrepreneurial CEO. You also double as treasurer and chief financial officer.

You have just incorporated (in Delaware) and invested $50,000 of your own money into the company—well, actually it’s your Great Aunt Lillian’s money. You’re going to need much more capital to get into production, but these initial transactions will start up the business. Follow along…we have a lot to do.

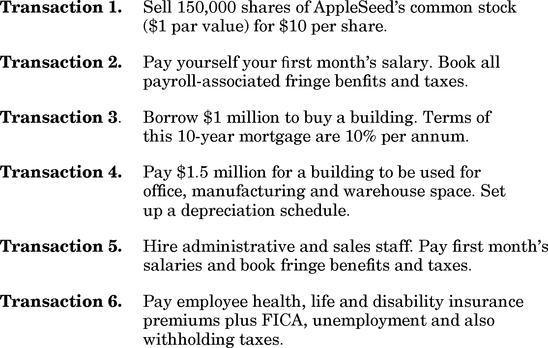

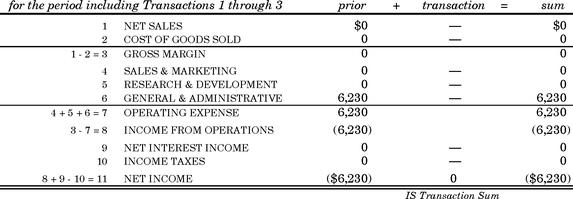

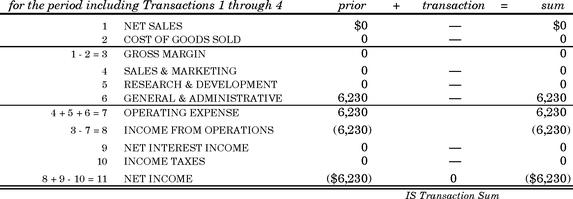

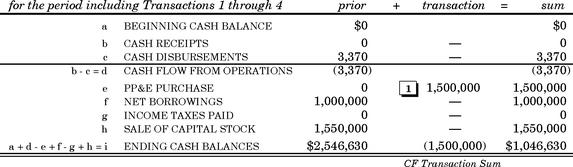

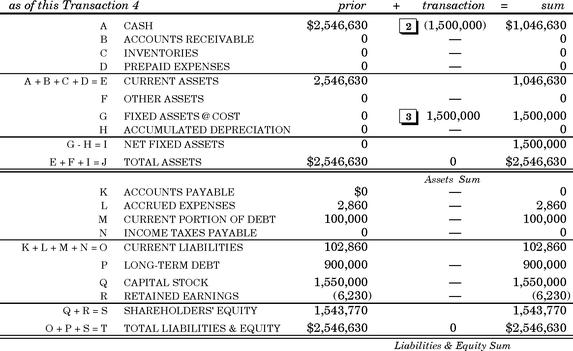

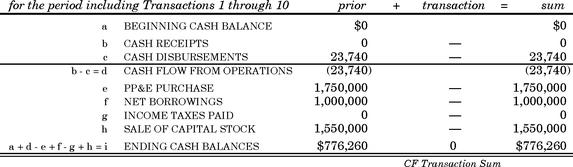

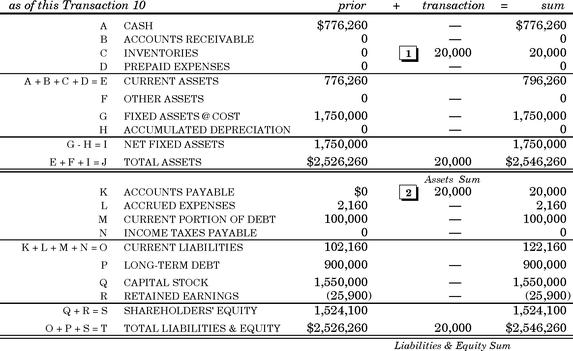

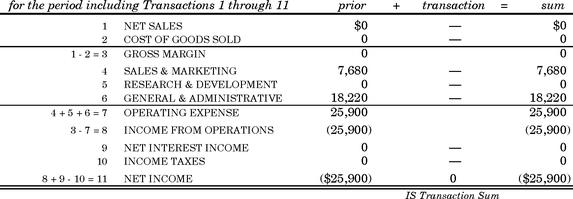

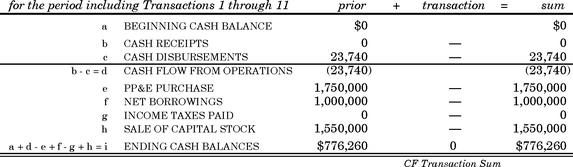

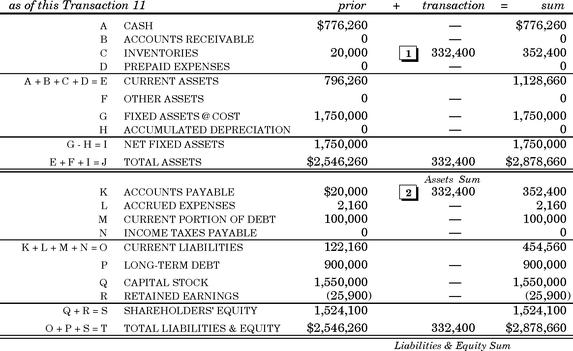

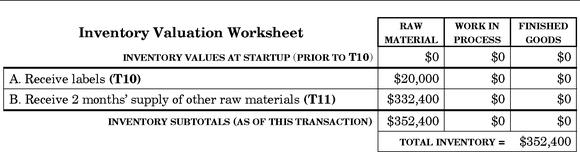

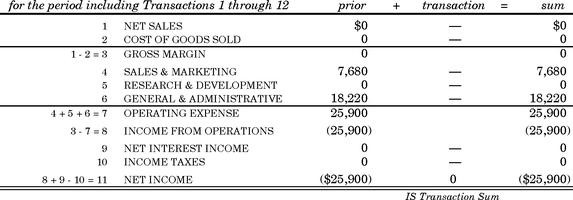

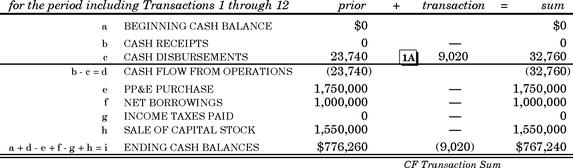

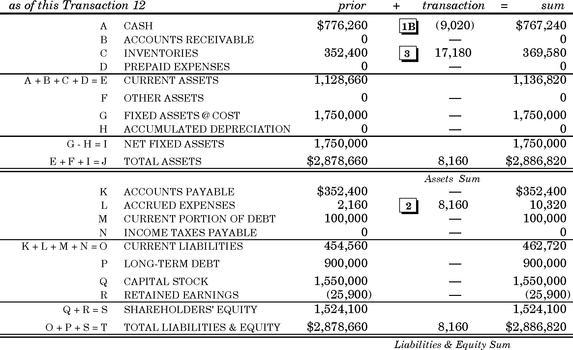

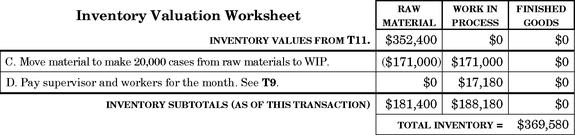

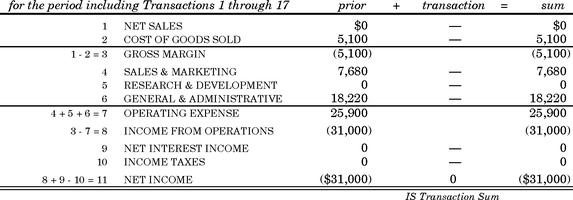

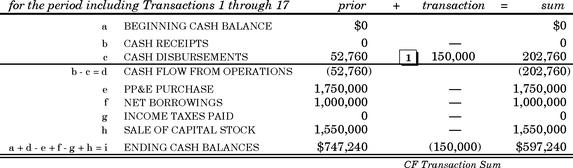

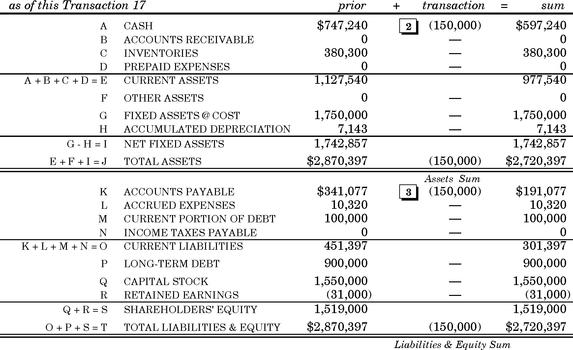

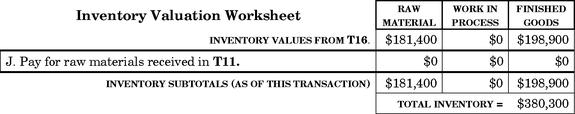

Income Statement

Cash Flow Statement

Balance Sheet

T1. Sell 150,000 shares of AppleSeed’s common stock (\$1 par value) for \$10 per share.

Shares of stock represent ownership in a corporation. A corporation can issue a single class or multiple classes of stock, each with different rights and privileges.

Common stock has the lowest preference to receive assets if the corporation is liquidated. Common stockholders vote for the board of directors.

Preferred stock has a preference over common stock when the corporation pays a dividend or distributes assets in liquidation. Usually, preferred stockholders do not have the right to vote for directors.

Note that claims of both the common and preferred stockholders are junior to claims of bondholders or other creditors of the company.

Par value is the dollar amount that is assigned to shares by the company’s charter. Par value has little significance other than to keep track of stock splits.

There is no connection between the stated par value and any underlying worth of the stock or the enterprise.

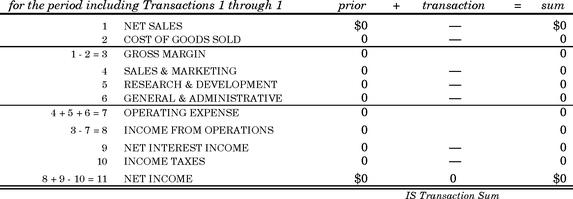

Transaction: A group of investors is willing to exchange their $1.5 million in cash for stock certificates representing 150,000 common shares of AppleSeed Enterprises, Inc.

Note: When you formed the company, you bought 50,000 shares of “founder’s stock” at \$1 per share for a total investment of \$50,000 in cash. Thus, after this sale to the investor group, there will be 200,000 shares outstanding. They will own 75% of AppleSeed and you will own the rest

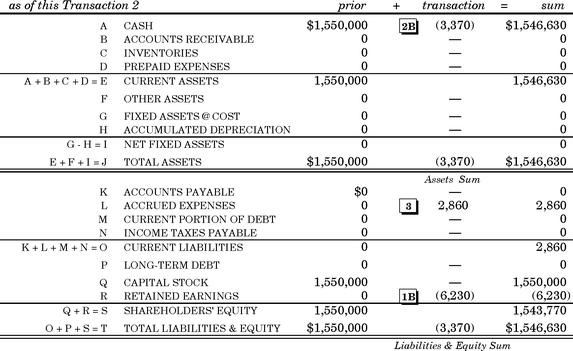

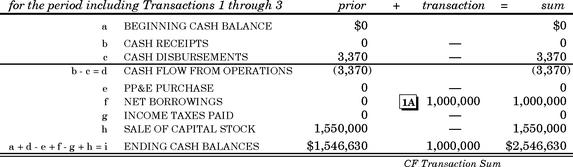

Take the money, issue the investors common stock certificates and run to the bank to deposit the check in AppleSeed’s checking account. The company has received cash, so on the Cash Flow Statement record the $1.5 million as SALE OF CAPITAL STOCK.

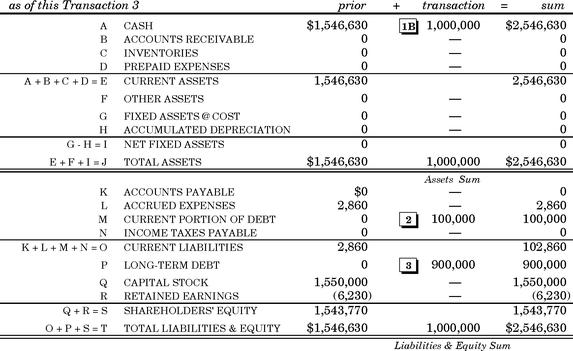

This $1.5 million in cash is a new asset for the corporation, so increase CASH in the Balance Sheet by the amount received from the investors.

Each new asset must create a corresponding liability (or offsetting asset) or the Balance Sheet will be out of balance. Issuing stock creates a liability for the company. In effect, AppleSeed “owes” the new stockholders a portion of its assets. So, increase the liability CAPITAL STOCK on the Balance Sheet by $1.5 million.

Income Statement

Cash Flow Statement

Balance Sheet

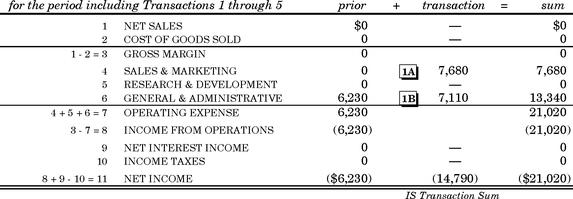

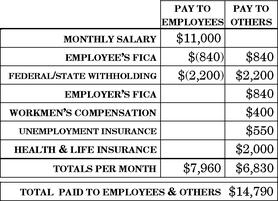

T2. Pay yourself a month’s salary. Book all payroll associated fringe benefits and taxes.

Congratulations! The board of directors of AppleSeed Enterprises, Inc., has hired you to manage the company at the grand salary of \$5,000 per month.

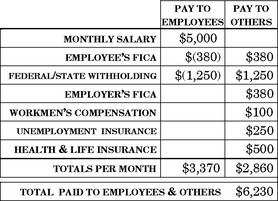

Before you spend all your newfound wealth, let’s calculate: (1) your actual take-home pay; (2) the cut for taxes; and (3) the total expense to the company for fringe benefits and payroll taxes.

See the table at right. It costs AppleSeed a total of \$6,230 to pay your \$5,000 in salary, even though you only receive \$3,370 in your paycheck.

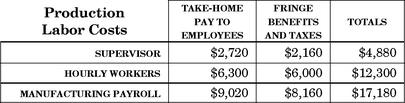

Salary & Employment Expenses

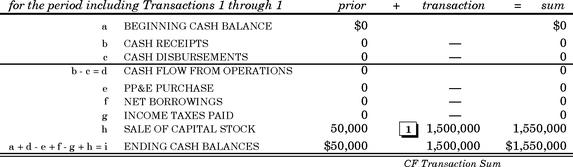

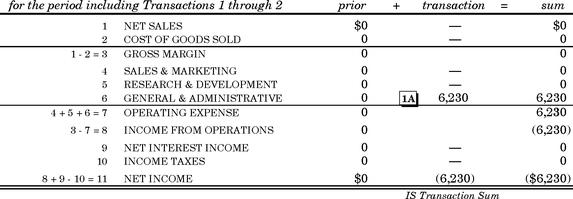

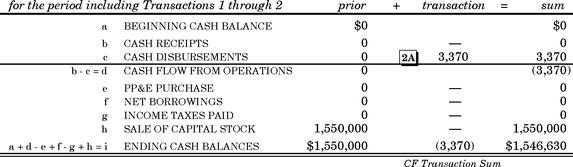

Transaction: Book all payroll-associated company expenses totaling \$6,230 including salary, employer’s contribution to FICA (Social Security) and various insurance expenses. Issue yourself a payroll check for \$3,370 (your \$5,000 monthly salary minus \$1,250 in federal and state withholding tax and \$380 for your own contribution to FICA).

(1A) Salary and fringes are expenses that decrease income. Add the total monthly payroll expense of $6,230 to GENERAL & ADMINISTRATIVE expenses in the Income Statement. (1B) Also decrease RETAINED EARNINGS in the Balance Sheet by the same amount.

(2A) So far your payroll check is the only cash that has left the company. List the $3,370 check under CASH DISBURSEMENTS in the Cash Flow Statement. (2B) Also decrease CASH in the Balance Sheet by the same amount.

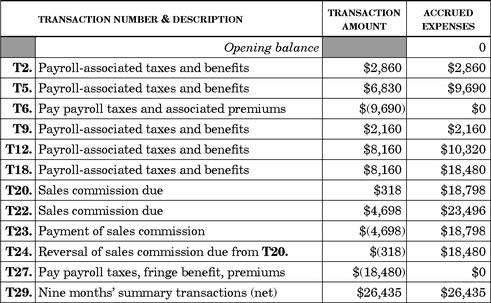

The remaining $2,860 in expenses—due to the government and to various insurance companies—is an obligation of the company not yet discharged (that is, owed but not yet paid). Enter this amount under ACCRUED EXPENSES in the liability section of the Balance Sheet.

Income Statement

Cash Flow Statement

Balance Sheet

T3. Borrow $1 million to buy a building. Terms of this 10-year mortgage are 10% interest per annum.

Go to the bank and apply for a loan to buy a building to (1) manufacture and warehouse applesauce, and (2) house the administrative and sales activities of the company.

The friendly loan officer agrees that AppleSeed has a strong equity capital base and good prospects. She agrees to lend you a cool million to buy the building but demands that you pledge all the assets of the company to collateralize the loan.

She also asks for your personal guarantee to repay the loan if the company can not. What do you say? The correct answer is no. If the business fails, you don’t want to lose your home too.

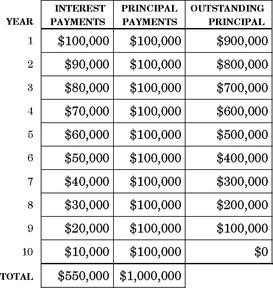

You and your friendly banker agree on a 10-year loan amortization (that is, payback) schedule shown on the right.

Loan Amortization Schedule

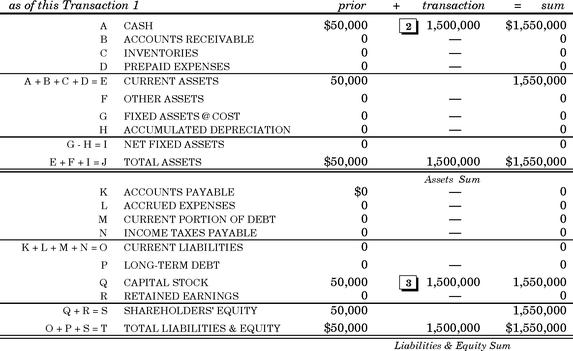

Transaction: Borrow \$1 million to purchase an all-purpose building. This term note will run for 10 years, calling for yearly principal payments of \$100,000 plus interest at a rate of 10% per annum.

(1A) At the loan closing the friendly banker deposits $1 million in your checking account, thus increasing NET BORROWINGS in the Cash Flow Statement. (1B) Remember also, CASH increases by $1 million in the assets section of the Balance Sheet.

The CURRENT PORTION OF DEBT (that is, the amount that will be repaid this year) is $100,000 and is listed in the current liabilities section of the Balance Sheet.

The remaining debt of $900,000 will be repaid more than one year in the future and thus is listed as long-term debt in the Balance Sheet.

Income Statement

Cash Flow Statement

Balance Sheet

T4. Pay $1.5 million for a building to be used for office, manufacturing and warehouse space. Set up a depreciation schedule.